EXHIBIT 99.1

Published on November 6, 2019

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action to be taken, please seek your own financial advice from your stockbroker, solicitor, accountant or other appropriately authorised independent financial adviser. If you have recently sold or transferred all of your shares in Endava plc you should forward this document and any accompanying documents to your bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. If you have sold or transferred only part of your holdings, you should retain these documents. The registered office of Endava plc is 125 Old Broad Street, London EC2N 1AR, United Kingdom. Tel: +44 20 7367 1000. Endava plc is incorporated and registered in England and Wales under the Companies Act 2006, with company number 5722669. www.endava.com Endava plc Notice of Annual General Meeting 2019 To be held at: the offices of Cooley (UK) LLP at Dashwood, 69 Old Broad Street, London EC2M 1QS, United Kingdom. On: Monday, 9 December 2019, commencing at 2:30 p.m. London time (9:30 a.m. EST). 1

How to vote Endava plc has three classes of ordinary shares: Class A ordinary shares, Class B ordinary shares and Class C ordinary shares. Class A ordinary shares are capable of being held in certificated form or dematerialised and held in CREST. Class A ordinary shares may also be represented by American Depositary Shares (“ADSs”). Class B ordinary shares and Class C ordinary shares are only capable of being held in certificated form. The rights of the holders of Class A ordinary shares, Class B ordinary shares and Class C ordinary shares and holders of ADSs are identical, except with respect to voting, conversion and transfer. The holders of ADSs or Class A ordinary shares (not represented by ADSs) are entitled to one vote per share, the holders of Class B ordinary shares are entitled to 10 votes per share and the holders of Class C ordinary shares are entitled to one vote per share, in each case on all matters that are subject to shareholder vote. Your votes matter. If you cannot attend the AGM, please vote your shares by appointing a proxy. You can vote by returning a paper form of proxy, if you received one. For more information: - holders of Class A ordinary shares (not represented by ADSs), Class B ordinary shares and Class C ordinary shares should refer to notes on pages 10 to 11; - holders of Class B ordinary shares and Class C ordinary shares should, in addition, refer to notes on page 12; and - holders of ADSs should refer to notes on pages 13 to 14. How to attend Please bring your admission card, if you have one. If you receive your notifications by email, you will be asked to show a copy, either on an electronic device or as a print out. Please be prepared to provide evidence of your shareholding and/or identity. If you are attending on behalf of a registered holder of shares you must bring photographic proof of identity and evidence of your appointment to represent that shareholder, including their admission card if possible. This includes people appointed as proxies, corporate representatives and those with power of attorney. For more information, see notes on pages 10 to 14. If you are bringing a guest, please let us know in advance. How to order paper copies You can order a paper copy of this notice or any other company report at www.endava.com. Copies will also be available at the AGM. 2

Chairman’s letter THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action to be taken, please seek your own financial advice from your stockbroker, solicitor, accountant or other appropriately authorised independent financial adviser. If you have recently sold or transferred all of your shares in Endava plc you should forward this document and any accompanying documents to your bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. If you have sold or transferred only part of your holdings, you should retain these documents. Dear Shareholder, 2019 Annual General Meeting of Endava plc I am pleased to confirm that the 2019 Annual General Meeting of Endava plc (the “AGM”) will take place at 2:30 p.m. London time (9:30 a.m. EST) on Monday, 9 December 2019 at the offices of Cooley (UK) LLP at Dashwood, 69 Old Broad Street, London EC2M 1QS, United Kingdom. Business of the AGM The business we will discuss at the AGM is made up of resolutions that are regularly brought to shareholders. Full details of the financial year in review are set out in the Company’s annual accounts for the financial year ended 30 June 2019 and the associated reports of the Directors and auditors (the “2019 Annual Report and Accounts”) and also in the Company’s 2019 Annual Report on Form 20-F, which can be found at https://investors.endava.com/financials- and-filings/AGM/. Recommendation The formal notice of AGM is set out on pages 4 to 5 of this notice and an explanation of each of the resolutions to be considered at the AGM may be found on pages 6 to 9 of this notice. Your directors (each, a “Director” and together, the “Board”) consider that all of the resolutions that are being proposed to the AGM are in the best interests of the Company and its shareholders as a whole and are most likely to promote the success of the Company. Accordingly, your Directors unanimously recommend that you vote in favour of the resolutions as each of the Directors with personal holdings of shares in the Company intends to do in respect of their own beneficial holdings of shares. Your votes do matter. Further information about how to vote and attend the AGM is given on pages 10 to 14 of this notice. Thank you for your ongoing support of Endava plc and I look forward to seeing you at the AGM. Yours faithfully, Trevor Smith Chairman 6 November 2019 3

Notice of 2019 Annual General Meeting Notice is hereby given that the 2019 Annual General Meeting (the “AGM”) of Endava plc (the “Company”) will be held at the offices of Cooley (UK) LLP, 69 Old Broad Street, London EC2M 1QS, United Kingdom on Monday, 9 December 2019 commencing at 2:30 p.m. London time (9:30 a.m. EST), for the transaction of the following business. The Company has three classes of ordinary shares: Class A ordinary shares, Class B ordinary shares and Class C ordinary shares. Class A ordinary shares are capable of being held in certificated form or dematerialised and held in CREST. Class A ordinary shares may also be represented by American Depositary Shares (“ADSs”). Class B ordinary shares and Class C ordinary shares are only capable of being held in certificated form. The rights of the holders of Class A ordinary shares, Class B ordinary shares and Class C ordinary shares and holders of ADSs are identical, except with respect to voting, conversion and transfer. The holders of ADSs or Class A ordinary shares (not represented by ADSs) are entitled to one vote per share, the holders of Class B ordinary shares are entitled to 10 votes per share and the holders of Class C ordinary shares are entitled to one vote per share, in each case, on all matters that are subject to shareholder vote. This notice is being sent to you because, as of Friday, 25 October 2019 (being the latest practicable date before publication of this notice), you are registered as a holder of Class A ordinary shares (not represented by ADSs), Class B ordinary shares or Class C ordinary shares in the register of members of the Company. However, this notice will also be available to holders of ADSs and contains information relevant to holders of ADSs. All resolutions to be considered at the AGM will be proposed as ordinary resolutions. That means that for each of the resolutions to be passed, more than half of the votes cast must be in favour of the resolution. You can order a paper copy of this notice or any other Company report at https://investors.endava.com/financials-and-filings/AGM/. Copies will also be available at the AGM. Ordinary resolutions Resolution 1 Report and accounts To receive and adopt the Company’s annual accounts for the financial year ended 30 June 2019 and the associated reports of the Directors and auditors (the “2019 Annual Report and Accounts”). See notes on page 6. Resolution 2 Directors’ remuneration report To approve the remuneration report of the directors of the Company (the “Directors”) set out on pages 60 to 67 (inclusive) of the 2019 Annual Report and Accounts. See notes on page 6. Resolution 3 Directors’ remuneration policy To approve the Directors’ remuneration policy set out on pages 52 to 59 (inclusive) of the 2019 Annual Report and Accounts, which will take effect immediately after the end of the AGM. See notes on page 6. 4

Notice of 2019 Annual General Meeting cont’d Resolution 4 Reappointment of auditors and determination of auditors’ remuneration To re-appoint KPMG LLP as auditors of the Company to hold office from the conclusion of the AGM until the conclusion of the AGM of the Company to be held in 2020 and to authorise the Directors to fix the auditors’ remuneration. See notes on page 6. Resolution 5 Director re-election To re-elect Mr. J Cotterell as a Director. See biography on page 7. Resolution 6 Director re-election To re-elect Mr. M Thurston as a Director. See biography on page 7. Resolution 7 Director re-election To re-elect Mr. A Allan as a Director. See biography on pages 7 to 8. Resolution 8 Director re-election To re-elect Mr. B Druskin as a Director. See biography on page 8. Resolution 9 Director re-election To re-elect Mr. M Kinton as a Director. See biography on page 8. Resolution 10 Director re-election To re-elect Mr. D Pattillo as a Director. See biography on page 8. Resolution 11 Director re-election To re-elect Mr. T Smith as a Director. See biography on page 8. Resolution 12 Director election To elect Ms. Sulina Connal as a Director. See biography on page 9. The results of polls taken on the resolutions at the AGM and any other information required by the Companies Act 2006 will be made available on the Company’s website (https://investors.endava.com/financials-and-filings/AGM/) as soon as reasonably practicable following the AGM and for the required period thereafter. BY ORDER OF THE BOARD The registered office of Endava plc is 125 Old Broad Street, London EC2N 1AR, United Kingdom. Tel: +44 20 7367 1000. Endava plc is incorporated and registered in England and Wales under the Rohit Bhoothalingam Companies Act 2006, with company Company Secretary number 5722669. 6 November 2019 5

Notes to resolutions Notes to resolution 1 Report and accounts The Companies Act 2006 requires the directors of a public company to lay before the company in general meeting copies of the directors’ reports, the independent auditors’ report and the audited financial statements of the company in respect of each financial year. For the Company’s financial year ended 30 June 2019, these are all contained in the 2019 Annual Report and Accounts. In accordance with best practice, the Company proposes an ordinary resolution to receive and adopt the 2019 Annual Report and Accounts, a copy of which may be found at: https://investors.endava.com/financials-and-filings/AGM/. In accordance with best practice, the resolution proposed is to receive and adopt the 2019 Annual Report and Accounts. Notes to resolution 2 Directors’ remuneration report Resolution 2 seeks shareholder approval for the Annual Statement by the Chairman of the Remuneration Committee and Annual Report on Remuneration which can found on pages 60- 67 (inclusive) of the 2019 Annual Report and Accounts. The Directors’ report on remuneration sets out details of each Director’s remuneration during the financial year ended 30 June 2019. In accordance with the relevant regulations, the resolution is an advisory vote and does not affect the remuneration already paid to any Director. Notes to resolution 3 Directors’ remuneration policy Resolution 3 seeks shareholder approval for the Directors’ remuneration policy as set out on pages 52 to 59 (inclusive) of the 2019 Annual Report and Accounts. In accordance with the requirements of the Companies Act 2006, as a UK public company listed on the New York Stock Exchange, the Company is required to establish a Directors’ remuneration policy. The Directors’ remuneration policy is required to be approved by shareholders at the first annual general meeting following the company being admitted to the New York Stock Exchange, by the passing of an ordinary resolution at the AGM. Accordingly, resolution 3 is a binding vote. The Directors’ remuneration policy sets out the Company’s forward-looking policy of Directors’ remuneration. If approved, the Directors’ remuneration policy will become effective following the AGM and valid for three years without further shareholder approval or until replaced by a new or amended Directors’ remuneration policy. Once approved, all payments to Directors and former Directors will need to be in accordance with the Directors’ remuneration policy unless payment has been separately approved by shareholders. Notes to resolution 4 Reappointment of auditors and determination of auditors’ remuneration Resolution 4 seeks shareholder approval for the reappointment of KPMG LLP as the Company’s auditors until the conclusion of the next AGM. This resolution also seeks authority to give the Directors the power to set the remuneration of the Company’s auditors. The Directors recommend KPMG LLP’s reappointment and seek authority to fix their remuneration. 6

Notes to resolutions cont’d Notes to resolutions 5 to 12 Re-election and election of Directors All the Directors are required by the Articles of Association to retire and offer themselves for re-election at each AGM. In accordance with this requirement Mr. J Cotterell, Mr. M Thurston, Mr. A Allan, Mr. B Druskin, Mr. M Kinton, Mr. D Pattillo and Mr. T Smith retire and offer themselves for re-election as Directors. Ms. Sulina Connal, who was appointed by the Board on 25 September 2019, shall retire and offer herself up for election as a Director. The nomination committee identifies, evaluates and recommends to the Board candidates for appointment or reappointment as Directors and for appointment as company secretary. The nomination committee keeps the diversity, mix of skills, experience and knowledge of the Board under regular review and seeks to ensure an orderly succession of Directors. The outside directorships and broader commitments of the non-executive directors (including time commitments) are also monitored by the nomination committee. The nomination committee’s reasons for the election or re-election of Directors are set out with the biography of each Director, as are descriptions of the Directors’ skills, experience and the committees upon which they serve. In respect of each of the non-executive Directors, the Board has fully considered whether each Director is free from any relationship that could materially interfere with the exercise of his or her independent judgement. The Board has determined that each of these non-executive directors is considered to be independent. All Directors are recommended by the Board for election or re-election. Resolution 5 John Cotterell – Chief Executive Officer John Cotterell founded the Company and has served as Chief Executive Officer and as a member of the Board since the Company’s inception in February 2000. Mr. Cotterell holds a B.Eng. from the University of Bristol and an M.B.A. from the Alliance Manchester Business School. The Board believe that Mr. Cotterell’s leadership of the Company since its inception and experience with information technology companies prior to founding the Company provide him with the qualifications and skills to serve as a Director. Resolution 6 Mark Thurston – Chief Financial Officer Mark Thurston has served as Chief Financial Officer of the Company and as a member of the Board since April 2015. From May 2011 to March 2015, Mr. Thurston served as Group Finance Director at Paragon Education and Skills Ltd. Mr. Thurston holds a Physics degree from Durham University and is a member of the Institute of Chartered Accountants in England and Wales. The Board believes that Mr. Thurston’s perspective and experience as Chief Financial Officer provide him with the qualifications and skills to serve as a Director. Resolution 7 Andrew Allan – Independent Director Andrew Allan has served as a member of the Board since April 2006, having previously served as a member of the board of Brains Direct Ltd, which was acquired by Endava in April 2006. He currently serves as Managing Partner at Fairways Corporate Finance, a position he has 7

Notes to resolutions cont’d held since May 2003. Mr. Allan is a qualified Chartered Accountant and a current member of the Institute of Chartered Accountants of Scotland. Mr. Allan holds a Bachelor’s degree in Finance from the University of Strathclyde. The Board believes that Mr. Allan’s business experience provide him with the qualifications and skills to serve as a Director. Resolution 8 Ben Druskin – Independent Director Ben Druskin has served as a member of the Board since September 2017. Mr. Druskin retired from Citigroup in August 2017. From 2014 until his retirement, Mr. Druskin served as the Chairman of the Global Technology, Media and Telecom Investment Banking Group. Prior to becoming Chairman, Mr. Druskin was co-head of the Global Technology, Media and Telecom Investment Banking Group. Mr. Druskin has served as a member of the Board of Zensar Technologies since November 2017. Mr. Druskin holds a B.A. in Economics from Rutgers College and an M.B.A. in Finance from The Stern School of Business at New York University. The Board believes that Mr. Druskin’s expertise in capital raising and mergers and acquisitions provide him with the qualifications and skills to serve as a Director. Resolution 9 Mike Kinton – Independent Director Mike Kinton has served as a member of the Board since April 2006. Since July 1999, Mr. Kinton has served as Managing Director at Kinton Technology Ltd. Mr. Kinton has served as a member of the Board of PaperRound HND Services Ltd, since February 2005 and Prmax Ltd., since March 2007. Mr. Kinton holds an M.A. from the University of Cambridge and a M.S. from London Business School. The Board believes that Mr. Kinton’s experience in the information technology industry, as well as his valuable experience gained from prior and current board service, provides him with the qualifications and skills to serve as a Director. Resolution 10 David Pattillo – Independent Director David Pattillo has served as a member of the Board since January 2017. From February 2014 to January 2019, Mr. Pattillo served as the Chief Financial Officer and member of the Board of ClearStar, Inc. From June 2012 to December 2013, Mr. Pattillo served as Manager of Dapa, LLC. Mr. Pattillo holds a B.S. from Clemson University and an MBA from the University of Georgia – Terry College of Business. The Board believes that Mr. Pattillo’s knowledge of the information technology industry provides him with the qualifications and skills to serve as a Director. Resolution 11 Trevor Smith – Chairman Trevor Smith has served as a member of the Board since June 2013 and as chairman since July 2016. Prior to his retirement, Mr. Smith held various roles at Goldman, Sachs & Co., an investment bank, including Chief Information Officer for the EMEA Region from January 2000 to September 2009 and in a part-time Business Resiliency & Crisis Management and Special Project role from March 2010 until June 2013. Mr. Smith holds a B.Sc. in Economics from UCW Aberystwyth. The Board believes that Mr. Smith’s experience in information technology and delivery of large projects provide him with the qualifications and skills to serve as a Director. 8

Notes to resolutions cont’d Resolution 12 Sulina Connal – Independent Director Sulina Connal has served as a member of the Board since September 2019. She has worked at the forefront of digital transformation most recently at Facebook where she has been a Director of Mobile and Connectivity Partnerships since October 2017. Prior to that, from April 2014 until September 2017, she was Senior Vice President of Strategic Partnerships at Orange. Sulina holds an M.A. from the University of Oxford. The Board believes that Ms. Connal’s knowledge of the information technology industry provides her with the qualifications and skills to serve as a Director. 9

Shareholder notes on voting Holders of Class A ordinary shares (not represented by ADS), Class B ordinary shares or Class C ordinary shares When is my voting entitlement fixed? To attend, speak and vote at the AGM you must be a registered holder of Class A ordinary shares (not represented by ADSs), Class B ordinary shares or Class C ordinary shares at 6:00 p.m. London time on Thursday, 5 December 2019 (or, if the AGM is adjourned, at 6:00 p.m. London time on the day two days prior to the adjourned meeting). Your voting entitlement will depend on the number of Class A ordinary shares (not represented by ADSs), Class B ordinary shares and Class C ordinary shares that you hold at that time. I can’t attend the meeting but want to vote – what do I do? If you are a registered holder and cannot attend, you can appoint the chair or any other person to attend, speak and vote on your behalf. This person is called your proxy. Your proxy does not have to be a shareholder. You can instruct your proxy how to vote. Where no specific instruction is given by you, your proxy may vote at their discretion or refrain from voting, as they see fit. You can appoint more than one proxy provided it is in relation to different shares within your holding. You can appoint a proxy and submit voting instructions by: - logging on to www.endava-shares.com and following the instructions; - completing and returning the paper form of proxy (if one has been sent to you). Please read the instructions carefully to ensure you have completed and signed the paper form of proxy correctly. Any alterations must be initialled. If one has not been sent to you, you may request a paper form of proxy directly from the registrars, Link Asset Services, on Tel: 0871 664 0300 or +44 371 664 0300 (outside the UK). Calls cost 12p per minute plus your phone company’s access charge. Calls outside the United Kingdom will be charged at the applicable international rate. Lines are open between 9:00 a.m. – 5:30 p.m. London time, Monday to Friday excluding public holidays in England and Wales; or - in the case of holders of Class A ordinary shares (not represented by ADS) only, those holders which are CREST members may utilise the CREST electronic proxy appointment service in accordance with the procedures set out in the notes to the notice of AGM. You will also need to give the admission card to your proxy to bring to the AGM, along with photographic proof of their identity. Proxies not properly notified to the Company’s registrar, Link Market Services Limited, may be denied access to the AGM and will be unable to vote. Giving your admission card to your proxy is not sufficient – they must also be appointed in advance using one of the above methods. If you own shares jointly, any one shareholder may sign the paper form of proxy. If more than one joint holder submits a paper form of proxy, the instruction given by the first listed on the shareholder register will prevail. 10

Shareholder notes on voting cont’d By when do I have to submit my vote? Proxy appointments and voting instructions, including any amendments, must be received by the Company’s registrar, Link Market Services Limited, by 2:30 p.m. London time on Thursday, 5 December 2019. If you miss this deadline and wish to submit a new vote or amend an existing vote, you can only do so by attending the AGM in person and voting. I already voted but have changed my mind – can I change my vote? You can submit a new voting instruction at any time before the time and date above. If you wish to amend a paper instruction you must do so in writing and sign your new voting instruction. The voting instruction received last will be the one that is followed. I hold shares on behalf of several others – can I vote part of the holding separately? You can appoint more than one proxy using a paper form provided it is in relation to different shares. Corporate shareholders may either appoint one or more proxies using the paper form or via CREST, or alternatively appoint one or more corporate representatives in relation to different shares. Multiple proxies and corporate representatives may all attend and speak at the AGM and may vote the shares that their respective appointments represent in different ways. 11

Shareholder notes on voting cont’d Holders of Class B or Class C ordinary shares I am a CREST member – can I use the CREST system to vote? Holders of Class B ordinary shares and Class C ordinary shares will not be able to use the CREST system to vote. Such shareholders must vote using a using a paper instruction or by appointing a proxy. I have a power of attorney from a holders of Class B ordinary shares or Class C ordinary shares – how can I vote? You can vote using the paper form of proxy only. You must ensure that the valid power of attorney and the paper form of proxy have been deposited with the Company’s registrar, Link Market Services Limited, by 2:30 p.m. London time on Thursday, 5 December 2019 12

Shareholder notes on voting cont’d Holders of ADSs When is my voting entitlement fixed? To attend, speak and vote at the AGM you must be a registered holder of ADSs at 5:00 p.m. EST on Thursday, 31 October 2019 (or 9:00 p.m. London time on the same day). Your voting entitlement will depend on the number of ASDs you hold at that time. The holders of ADSs are entitled to one vote per ADS on all matters that are subject to shareholder vote. Given the greater number of votes per share attributed to Class B ordinary shares, these shareholders will, assuming no dispositions of Class B ordinary shares by such shareholders between Friday, 25 October 2019 (the latest practicable date before publication of this notice) and Monday, 9 December 2019, collectively beneficially hold shares representing approximately 87.6% of the voting rights of the outstanding share capital. Further, John Cotterell, the Chief Executive Officer of Endava, will beneficially hold Class B ordinary shares representing approximately 37.0% of the voting rights of the outstanding share capital of Endava. Consequently, Mr. Cotterell will continue to be able to have a significant influence on corporate matters submitted to a vote of shareholders. How can you attend the AGM in person? If you wish to attend the AGM in person, you must give notice to the Company of your attendance by completing and delivering a Notice of Attendance to Citibank, N.A. in its capacity as ADR and Transfer Agent for Endava’s ADR program at P.O. BOX 43099, Providence, Rhode Island 02940-5000 on or before 3 December 2019 (10:00 a.m. EST). You will also need to make arrangements with your broker to provide evidence of your share holdings as of 5:00 p.m. ET on Thursday 31 October 2018, the ADS record date. To do so you should contact Citibank, N.A. - ADR Shareholder Services at 1-877-248-4237 (Mon-Fri 8:30 a.m. - 6:00 p.m. EST). I can’t attend the meeting but want to vote – what do I do? If you cannot attend you can instruct the depositary, Citibank, N.A. (the “Depositary”), or any other person to vote on your behalf. You can instruct the Depositary to vote on your behalf by completing and returning the paper ADS voting instruction card (if one has been sent to you). Please read the instructions carefully to ensure you have completed and signed the card correctly. Any alterations must be initialled. Proxies not notified to the Depositary may be denied access to the AGM and will be unable to vote. By when do I have to submit my vote? Paper voting instructions, including any amendments, must be received by the Depositary by 10:00 a.m. EST on 3 December 2019. If your instructions are not received by the Depositary by the appointed times, then under the terms of the Deposit Agreement between the Company and the Depositary your ADSs may, under certain circumstances, be voted by a person designated by the Company. 13

Shareholder notes on voting cont’d I already voted but have changed my mind – can I change my vote? You can submit a new instruction at any time during the voting period. If you wish to amend a paper instruction you must do so in writing and sign your new instruction. The voting instruction received last will be the one that is followed. I hold my shares in a street name – can I still vote? You should contact your bank, broker or nominee for information on how to vote your ADSs. If you wish to attend the AGM, you will need to bring with you evidence of your share ownership in the form of a currently dated letter from your bank or broker and photographic ID. On verification of such evidence, you may attend the AGM but may not speak or vote your shares at the AGM. 14

Other information A copy of this notice and other information required by the Companies Act 2006 can be found at https://investors.endava.com/financials-and-filings/AGM/. Information rights Under the Companies Act 2006, there are a number of rights that may now be available to indirect investors of the Company, including the right to be nominated by the registered holder to receive general shareholder communications direct from the Company. The rights of indirect investors who have been nominated to receive communications from the Company in accordance with section 146 of the Companies Act 2006 (“nominated persons”) do not include the right to appoint a proxy. However, nominated persons may have a right under an agreement with the registered shareholder who holds the shares on their behalf to be appointed (or to have someone else appointed) as a proxy. Alternatively, if nominated persons do not have such a right or do not wish to exercise it, they may have a right under such an agreement to give instructions to the person holding the shares as to the exercise of voting rights. If you have been so nominated to receive general shareholder communications direct from the Company, it is important to remember that your main contact in terms of your investment remains with the registered shareholder or custodian or broker, or whoever administers the investment on your behalf. You should also deal with them in relation to any rights that you may have under agreements with them to be appointed as a proxy and to attend, participate in, and vote at the AGM, as described above. Any changes or queries relating to your personal details and holding (including any administration thereof) must continue to be directed to your existing contact at your investment manager or custodian. The Company cannot guarantee dealing with matters that are directed to us in error. The only exception to this is where the Company is exercising one of its powers under the Companies Act 2006 and writes to you directly for a response. Statements related to the audit Members satisfying the thresholds in section 527 of the Companies Act 2006 can require the Company to publish a statement on its website setting out any matter relating to: a. the audit of the Company’s accounts (including the auditor’s report and the conduct of the audit) that are to be laid before the AGM; and b. any circumstances connected with an auditor of the Company ceasing to hold office since the last AGM, that the members propose to raise at the AGM. The Company cannot require the members requesting the publication to pay its expenses in connection with the publication. The company must forward a copy of the statement to the auditors when it publishes the statement on the website. The business which may be dealt with at the AGM includes any such statement that the company has been required to publish on its website. Shareholder requisition rights Members satisfying the thresholds in section 338 of the Companies Act 2006 can require the Company: 15

Other information a. to give, to members of the Company entitled to receive notice of the AGM, notice of a resolution which may properly be moved, and which those members intend to move, at the AGM; and b. to include in the business to be dealt with at the AGM any matter (other than a proposed resolution) which may properly be included in the business at the AGM, provided in each case that the requirements of those sections are met and provided that the request is received by the company not later than six clear weeks before the AGM or if later the time at which notice is given of the AGM. Total voting rights and share capital The Company has three classes of ordinary shares: Class A ordinary shares, Class B ordinary shares and Class C ordinary shares. Class A ordinary shares are capable of being held in certificated form or dematerialised and held in CREST. Class A ordinary shares may also be represented by ADSs. Class B ordinary shares and Class C ordinary shares are only capable of being held in certificated form. The rights of the holders of Class A ordinary shares, Class B ordinary shares and Class C ordinary shares and holders of ADSs are identical, except with respect to voting, conversion and transfer. The holders of ADSs or Class A ordinary shares (not represented by ADSs) are entitled to one vote per share, the holders of Class B ordinary shares are entitled to 10 votes per share and the holders of Class C ordinary shares are entitled to one vote per share, in each case on all matters that are subject to shareholder vote. As at Friday, 25 October 2019 (the latest practicable date before the publication of this notice), the issued share capital of the Company was comprised of 19,356,442 Class A ordinary shares, 22,562,844 Class B ordinary shares and 12,516,701 Class C ordinary shares with a nominal value of £0.02 per share, respectively. Therefore, the total number of voting rights as at Friday, 25 October 2019 (the latest practicable date before publication of this notice) was 257,501,583. 16

Other information Notes: 1. Shareholders, or their proxies, intending to attend the AGM in person are requested, if possible, to arrive at the AGM venue at least 20 minutes prior to the commencement of the AGM at 2:30 p.m. London time on Monday, 9 December 2019, so that their shareholding may be checked against the Company’s Register of Members and attendances recorded. 2. You can vote either: 2.1. by logging on to www.endava-shares.com and following the instructions; 2.2. to the extent that you have not received a proxy, you may request a hard copy form of proxy directly from the registrars, Link Asset Services Limited, on Tel: 0871 664 0300 or +44 371 664 0300 (outside the UK). Calls cost 12p per minute plus your phone company’s access charge. Calls outside the United Kingdom will be charged at the applicable international rate. Lines are open between 9:00 a.m. – 5:30 p.m. London time, Monday to Friday excluding public holidays in England and Wales; or 2.3. in the case of CREST members, by utilising the CREST electronic proxy appointment service in accordance with the procedures set out below. 3. A form of proxy has been provided for use by members. To be valid it should be completed, signed and delivered (together with the power of attorney or other authority (if any) under which it is signed, or a notarially certified copy of such power or authority) to the Company’s registrars, Link Market Services Limited, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU, United Kingdom, not later than 48 hours (not including non-business days) before the time appointed for holding the AGM (2:30 p.m. London time on Thursday, 5 December 2019) or any adjourned AGM or, in the case of a poll taken more than 48 hours after it is demanded, not less than 24 hours before the time appointed for the taking of the poll. 4. If you return more than one proxy appointment, either by paper or electronic communication, the appointment received last by the Registrar before the latest time for the receipt of proxies will take precedence. You are advised to read the terms and conditions of use carefully. Electronic communication facilities are open to all shareholders and those who use them will not be disadvantaged. 5. In the case of a corporation, the form of proxy must be executed under its common seal or signed on its behalf by an attorney or a duly authorised officer of the corporation. A corporation which is a member can appoint one or more corporate representatives who may exercise on its behalf all its powers as a member provided that they do not do so in relation to the same shares. 6. In the case of joint holders, the vote of the senior who tenders a vote whether in person or by proxy will be accepted to the exclusion of the votes of any other joint holders. For these purposes, seniority shall be determined by the order in which the names stand in the Company’s relevant register of members for the certificated or uncertificated shares of the Company (as the case may be) in respect of the joint holding. 7. The return of a completed form of proxy, electronic filing or any CREST Proxy Instruction (as described in note 9 below) will not prevent a shareholder from attending the AGM and voting in person if they wish to do so. 8. CREST members who wish to appoint a proxy or proxies through the CREST electronic proxy appointment service may do so for the AGM (and any adjournment of the AGM) by using the procedures described in the CREST Manual (available from www.euroclear.com/site/public/EUI). CREST Personal Members or other CREST sponsored members, and those CREST members who have appointed a service provider(s), should refer to their CREST sponsor or voting service provider(s), who will be able to take the appropriate action on their behalf. 9. In order for a proxy appointment or instruction made by means of CREST to be valid, the appropriate CREST message (a ‘CREST Proxy Instruction’) must be properly authenticated in 17

Other information accordance with Euroclear UK & Ireland Limited’s specifications and must contain the information required for such instructions, as described in the CREST Manual. The message must be transmitted so as to be received by the issuer’s agent (ID RA10) by 2:30 p.m. London time on Thursday, 5 December 2019. For this purpose, the time of receipt will be taken to mean the time (as determined by the timestamp applied to the message by the CREST application host) from which the issuer’s agent is able to retrieve the message by enquiry to CREST in the manner prescribed by CREST. After this time, any change of instructions to proxies appointed through CREST should be communicated to the appointee through other means. 10. CREST members and, where applicable, their CREST sponsors or voting service providers should note that Euroclear UK & Ireland Limited does not make available special procedures in CREST for any particular message. Normal system timings and limitations will, therefore, apply in relation to the input of CREST Proxy Instructions. It is the responsibility of the CREST member concerned to take (or, if the CREST member is a CREST personal member, or sponsored member, or has appointed a voting service provider(s), to procure that his CREST sponsor or voting service provider(s) take(s)) such action as shall be necessary to ensure that a message is transmitted by means of the CREST system by any particular time. In this connection, CREST members and, where applicable, their CREST sponsors or voting system providers are referred, in particular, to those sections of the CREST Manual concerning practical limitations of the CREST system and timings. The Company may treat as invalid a CREST Proxy Instruction in the circumstances set out in Regulation 35(5)(a) of the Uncertificated Securities Regulations 2001. 11. Under Section 527 of the Companies Act 2006, shareholders meeting the threshold requirements set out in that section have the right to require the Company to publish on a website a statement setting out any matter relating to: (i) the audit of the Company’s financial statements (including the Auditor’s Report and the conduct of the audit) that are to be laid before the AGM; or (ii) any circumstances connected with an auditor of the Company ceasing to hold office since the previous meeting at which annual financial statements and reports were laid in accordance with Section 437 of the Companies Act 2006 (in each case) that the shareholders propose to raise at the relevant meeting. The Company may not require the shareholders requesting any such website publication to pay its expenses in complying with sections 527 or 528 of the Companies Act 2006. Where the Company is required to place a statement on a website under section 527 of the Companies Act 2006, it must forward the statement to the Company’s auditor not later than the time when it makes the statement available on the website. The business which may be dealt with at the AGM for the relevant financial year includes any statement that the Company has been required under section 527 of the Companies Act 2006 to publish on a website. 12. Any shareholder attending the AGM has the right to ask questions. The Company must cause to be answered any such question relating to the business being dealt with at the AGM but no such answer need be given if: (a) to do so would interfere unduly with the preparation for the AGM or involve the disclosure of confidential information; (b) the answer has already been given on a website in the form of an answer to a question; or (c) it is undesirable in the interests of the Company or the good order of the AGM that the question be answered. 13. The following documents are available for inspection during normal business hours at the registered office of the Company on any business day from the date of this notice until the time of the AGM and may also be inspected at the AGM venue, as specified in this notice, from 9:00 a.m. London time on the day of the AGM until the conclusion of the AGM: 13.1. the executive directors’ service contracts; and 13.2. letters of appointment of the non-executive directors. 14. You may not use any electronic address (within the meaning of section 333(4) of the Companies Act 2006) provided in either this notice or any related documents (including the form of proxy) to communicate with the Company for any purposes other than those expressly stated. 18

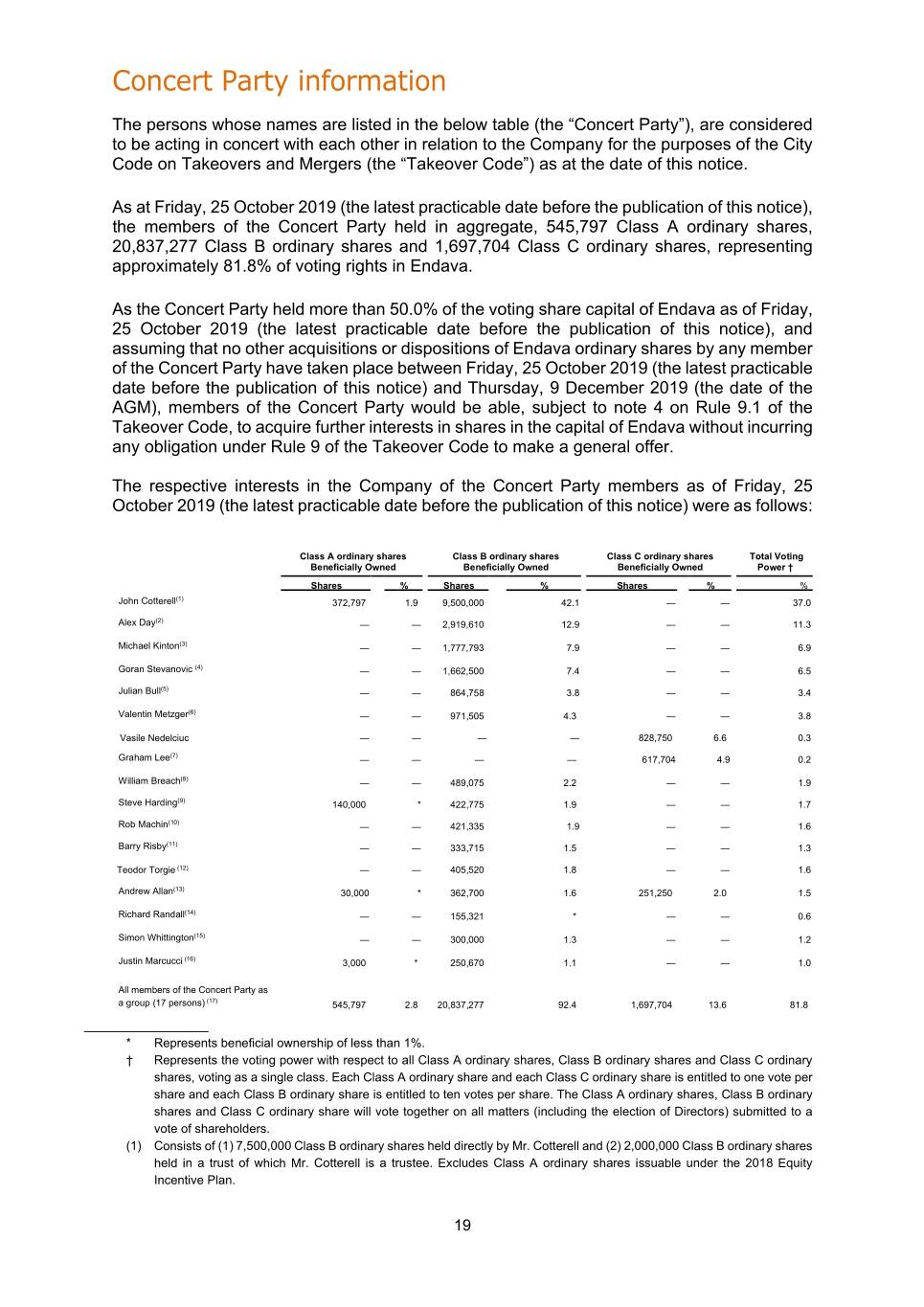

Concert Party information The persons whose names are listed in the below table (the “Concert Party”), are considered to be acting in concert with each other in relation to the Company for the purposes of the City Code on Takeovers and Mergers (the “Takeover Code”) as at the date of this notice. As at Friday, 25 October 2019 (the latest practicable date before the publication of this notice), the members of the Concert Party held in aggregate, 545,797 Class A ordinary shares, 20,837,277 Class B ordinary shares and 1,697,704 Class C ordinary shares, representing approximately 81.8% of voting rights in Endava. As the Concert Party held more than 50.0% of the voting share capital of Endava as of Friday, 25 October 2019 (the latest practicable date before the publication of this notice), and assuming that no other acquisitions or dispositions of Endava ordinary shares by any member of the Concert Party have taken place between Friday, 25 October 2019 (the latest practicable date before the publication of this notice) and Thursday, 9 December 2019 (the date of the AGM), members of the Concert Party would be able, subject to note 4 on Rule 9.1 of the Takeover Code, to acquire further interests in shares in the capital of Endava without incurring any obligation under Rule 9 of the Takeover Code to make a general offer. The respective interests in the Company of the Concert Party members as of Friday, 25 October 2019 (the latest practicable date before the publication of this notice) were as follows: Class A ordinary shares Class B ordinary shares Class C ordinary shares Total Voting Beneficially Owned Beneficially Owned Beneficially Owned Power † Shares % Shares % Shares % % (1) John Cotterell 372,797 1.9 9,500,000 42.1 — — 37.0 (2) Alex Day — — 2,919,610 12.9 — — 11.3 (3) Michael Kinton — — 1,777,793 7.9 — — 6.9 (4) Goran Stevanovic — — 1,662,500 7.4 — — 6.5 (5) Julian Bull — — 864,758 3.8 — — 3.4 (6) Valentin Metzger — — 971,505 4.3 — — 3.8 Vasile Nedelciuc — — — — 828,750 6.6 0.3 (7) Graham Lee — — — — 617,704 4.9 0.2 (8) William Breach — — 489,075 2.2 — — 1.9 (9) Steve Harding 140,000 * 422,775 1.9 — — 1.7 (10) Rob Machin — — 421,335 1.9 — — 1.6 (11) Barry Risby — — 333,715 1.5 — — 1.3 Teodor Torgie (12) — — 405,520 1.8 — — 1.6 (13) Andrew Allan 30,000 * 362,700 1.6 251,250 2.0 1.5 (14) Richard Randall — — 155,321 * — — 0.6 (15) Simon Whittington — — 300,000 1.3 — — 1.2 (16) Justin Marcucci 3,000 * 250,670 1.1 — — 1.0 All members of the Concert Party as (17) a group (17 persons) 545,797 2.8 20,837,277 92.4 1,697,704 13.6 81.8 ________________ * Represents beneficial ownership of less than 1%. † Represents the voting power with respect to all Class A ordinary shares, Class B ordinary shares and Class C ordinary shares, voting as a single class. Each Class A ordinary share and each Class C ordinary share is entitled to one vote per share and each Class B ordinary share is entitled to ten votes per share. The Class A ordinary shares, Class B ordinary shares and Class C ordinary share will vote together on all matters (including the election of Directors) submitted to a vote of shareholders. (1) Consists of (1) 7,500,000 Class B ordinary shares held directly by Mr. Cotterell and (2) 2,000,000 Class B ordinary shares held in a trust of which Mr. Cotterell is a trustee. Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. 19

Concert Party information cont’d (2) Excludes (1) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (2) Class A Shares issuable under the 2018 Sharesave Plan. (3) Excludes (1) Class A ordinary shares issuable under the Non-Executive Director Plan and (2) Class A ordinary shares issuable under the 2018 Non-Employee Sub Plan. (4) Excludes (1) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (2) Class A Shares issuable under the 2018 Sharesave Plan. (5) Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. (6) Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. (7) Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. (8) Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. (9) Excludes (1) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (2) Class A Shares issuable under the 2018 Sharesave Plan. (10) Excludes (1) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (2) Class A Shares issuable under the 2018 Sharesave Plan. (11) Excludes (1) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (2) Class A Shares issuable under the 2018 Sharesave Plan. (12) Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. (13) Includes 101,250 Class C ordinary shares held by Mr. Allan's spouse and 180,000 Class C ordinary shares held by Mr. Allan's lineal descendants. Excludes (1) 3,750 Class A ordinary shares issuable under the Non-Executive Director Plan and (2) 7,500 Class A ordinary shares issuable under the 2018 Non-Employee Sub Plan. (14) Excludes Class A ordinary shares issuable under the 2018 Equity Incentive Plan. (15) Excludes (1) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (2) Class A Shares issuable under the 2018 Sharesave Plan. (16) Excludes (1) 14,662 Class A ordinary shares issuable under the LTIP, (2) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (3) Class A Shares issuable under the 2018 Sharesave Plan. (17) Excludes (1) 14,662 Class A ordinary shares held in trust by the EBT pursuant to the LTIP, (2) 7,500 Class A ordinary shares issuable under the Endava 2017 Non-Executive Director Long Term Incentive Plan, (3) Class A ordinary shares issuable under the 2018 Equity Incentive Plan and (4) Class A Shares issuable under the 2018 Sharesave Plan. As of Friday, 25 October 2019 (the latest practicable date before the publication of this notice), John Cotterell, the Company’s Chief Executive Officer, beneficially held shares representing approximately 37.0% of the voting rights of the outstanding share capital of the Company. Accordingly, except with the consent of the Takeover Panel, Mr. Cotterell will not be able to acquire further or additional interests in shares that increase the percentage of shares carrying voting rights in which he is interested without being required to make a mandatory offer to all holders of any class of existing share capital or other class of securities carrying voting rights in the Company to acquire the balance of all such interests in the Company. In the event that other holders of Class B Ordinary Shares sell or transfer their shares to third parties, this may result in Mr. Cotterell’s interest in the Company passively increasing as a percentage of total shares carrying voting rights outstanding. Under these circumstances, Mr. Cotterell may be required to make a mandatory offer, unless the Takeover Panel agrees to grant a dispensation (which may be subject to conditions, including a vote of disinterested shareholders). To prevent any requirement on the part of Mr. Cotterell (or any other holder of Class B Ordinary Shares) from being subject to an obligation to make a mandatory offer as a result of an acquisition of any class of Ordinary Shares carrying voting rights or a passive increase in voting rights held, the Company’s articles of association contain certain provisions for an appropriate number of Class B Ordinary Shares held by him to be redesignated as Class A Ordinary Shares or Class C Ordinary Shares so that the relevant percentage of interests in any shares carrying voting rights do not increase and/or trigger the requirement to make a mandatory offering. 20

Contact details Endava plc Registered Office 125 Old Broad Street London EC2N 1AR United Kingdom Tel: +44 20 7367 1000 Registrar Link Market Services Limited The Registry 34 Beckenham Road Beckenham Kent BR3 4TU United Kingdom Tel: 0871 664 0300 Tel: +44 371 664 0300 (outside the UK) ADS Depositary Citibank Shareholder Services P.O. Box 43077 Providence, Rhode Island 02940-3077 USA Tel: 1-877-CITI-ADR (toll free) Tel: 1-781-575-4555 (outside US) Fax 1-201-324-3284 E-mail at: Citibank@shareholders-online.com 21