EX-11.1

Published on September 19, 2024

endava.com Share Dealing Code Endava PLC | August 2024

Share Dealing Code Endava PLC | August 2024 2 Contents 1 Introduction ....................................................................................................... 3 2 Purpose of Code ............................................................................................... 3 3 Persons Subject to This Code ......................................................................... 4 4 Insiders .............................................................................................................. 4 5 What Kinds of Transactions are Subject to this Code? ................................ 5 5.1 Transactions Subject to this Code .......................................................................... 5 5.2 Transactions Prohibited by this Code ..................................................................... 5 6 What is Material Non-Public Information? ...................................................... 5 6.1 Material information ................................................................................................ 5 6.2 When Information is Considered Public .................................................................. 6 7 When Can I Buy and Sell the Company’s Securities ..................................... 7 7.1 Generally................................................................................................................ 7 7.2 Trading Windows for Insiders ................................................................................. 7 7.3 Event-Specific Trading Blackouts ........................................................................... 7 7.4 Exceptions for Special Circumstances ................................................................... 8 8 Clearance Procedures ...................................................................................... 8 9 Exceptions to this Code ................................................................................... 9 9.1 Exercising Vested Options ..................................................................................... 9 9.2 10b5-1 Automatic Trading Programs. ..................................................................... 9 10 Code’s Duration ................................................................................................ 9 11 Individual Responsibility ................................................................................. 9 12 Breach of the Code ......................................................................................... 10 13 Governance and Oversight ............................................................................ 10 14 Amendments ................................................................................................... 10

Share Dealing Code Endava PLC | August 2024 3 1 Introduction Endava plc (hereafter, “Endava” or the “Company”) has a clear and unchanging purpose to create an environment and culture that breeds success, enabling our people to be the best they can be. It is underpinned by our values which guide the way we behave. Our policies support Endava's Code of Conduct, which focuses our attention on working respectfully with each other, on helping our clients to succeed by recognizing them as individuals, and on mitigating risk by delivering responsibly to the market and to our investors. The Company has established this Share Dealing Code (“Code”) to support our Open and Trusted values; and as part of our commitment to conducting business in accordance with the highest ethical standards, observing all applicable laws and regulations in the jurisdictions where we operate. This Code will help ensure that employees, members of the Company’s Board of Directors (“directors”), contractors and consultants of the Company and its subsidiaries, do not abuse, and do not place themselves under suspicion of abusing inside information, and comply with their obligations under the US Securities and Exchange (“SEC”) rules, US insider trading laws and/or the EU and UK Market Abuse Regulations. Generally speaking, “insider dealing” (also commonly referred to as “insider trading”) is the buying or selling of stocks, bonds, futures or other securities by someone who possesses or is otherwise aware of material nonpublic information about the securities or the issuer of the securities. Insider dealing also includes dealing in derivatives (such as put or call options) where the price is linked to the underlying price of a company’s shares. This Code sets forth guidelines with respect to transactions in the Company’s securities and in the securities of other applicable publicly traded companies, in each case by our employees, directors, contractors and consultants as described below. 2 Purpose of Code Employees, directors, contractors or consultants of Endava (or any other person or entity subject to this Code) who are aware of material non-public information (“MNPI”) relating to Endava may not, directly or indirectly: 1. trade or deal in the Company’s securities, except as otherwise specified in Section 9, “Exceptions to this Code” below; 2. recommend the purchase or sale of any of the Company’s securities; 3. disclose MNPI to persons within Endava whose jobs do not require them to have that information, or outside of Endava to other persons, such as family, friends, business associates and investors; or 4. assist anyone engaged in the above activities. The prohibition against insider dealing is absolute. It applies even if the decision to deal is not based on such MNPI. It also applies to transactions that may be necessary or justifiable for independent reasons (such as the need to raise money for an emergency expenditure) and also to very small transactions. All that matters is whether you are aware of any MNPI relating to Endava at the time of the transaction. It is also important to note that the laws prohibiting insider dealing are not limited to dealing or trading by the insider alone; advising others to trade on the basis of MNPI is illegal and squarely prohibited by this Code. Liability in such cases can extend both to the “tippee”—the person to whom the insider disclosed MNPI—and to the “tipper,” the insider himself or herself.

Share Dealing Code Endava PLC | August 2024 4 In such cases, you can be held liable for your own transactions, as well as the transactions by a tippee and even the transactions of a tippee’s tippee. In addition, no person subject to this Code who, in the course of his or her relationship with Endava, learns of any confidential information that is material to another publicly traded company with which Endava does business, including a customer or supplier of Endava or its subsidiaries, may trade in that other company’s securities until the information becomes public or is no longer material to that other company. There are no exceptions to this Code, except as specifically noted below. 3 Persons Subject to This Code Each employee, director, contractor and consultant of the Company is subject to this Code. This Code also extends to members of your immediate family - this is for your own protection. "Immediate family" includes one’s spouse or domestic partner, and any relative by blood, adoption or marriage living in one’s household. This includes, but is not limited, to children (including adult children), step-children (including adult step-children), grandchildren, parents, step-parents, grandparents, siblings, parents’ other children and siblings-in-law. This Code also applies to any other individuals or entities whose transactions in securities you influence, direct, or control (including, for example, a venture or other investment fund, if you influence, direct, or control transactions by such fund). The foregoing persons who are deemed subject to this Code are referred to in this Code as “Related Persons.” You are responsible for making sure that your Related Persons comply with this Code. If you are in any doubt as to whether a family member or other individual or entity is subject to this Code by virtue of their relationship to you, please contact the Endava Company Secretariat team by emailing endava.co.sec@endava.com. 4 Insiders Because the executive officers, directors and certain members of management and employees who have been notified of their designation (“Permanent Insiders”), are most likely to have regular access to MNPI about Endava, we require them to do more than refrain from insider dealing. Designation of certain members of management and employees as a Permanent Insider is based on several criteria, including grade, membership in a business unit, group or discipline or a specific job position with access to systems with sensitive information. In addition, other senior members of Endava will be considered Permanent Insiders if any such person is involved in activities within the organization that might be considered strategically important or be likely, if such activities were in the public domain, to affect the market price of the Company's securities. For the avoidance of doubt, directors and executive officers will at all times during his or her service to the Company be considered to be a Permanent Insider. As detailed in Section 7 below, we have established “quarterly trading blackout periods” when Permanent Insiders will be prohibited from dealing or trading in the Company's securities, which we refer to as “Closed Periods.” In addition to Permanent Insiders, the Company may from time to time identify individuals as being in possession of MNPI due to an event or involvement in an active project (“Project Insiders”). Project Insiders will also be restricted from dealing or trading in Endava securities. See Section 7.3, “Event-Specific Trading Blackouts” for additional information on when you are permitted to sell securities.

Share Dealing Code Endava PLC | August 2024 5 Your status as an Insider remains in place whilst you are on extended leave, including parental leave and any unpaid leave. Additionally, for Project Insiders, your status as an Insider will remain in place until you are released from the project, or until the project has concluded and been announced, or has terminated. As such, you must continue to adhere to your obligations as set out in this Code, even if your access to MNPI or any Endava systems will be removed or suspended for the duration of your leave. Endava will maintain a list of Insiders, which will be reviewed and modified from time to time. Endava will notify each individual of any change in his or her status as a Permanent Insider and/or Project Insider under this Code. If you are unsure of your Insider status, please contact the Endava Company Secretariat team by emailing endava.co.sec@endava.com or the Group Head of Integrity at head.integrity@endava.com. Requests to be removed from the Insider List will not be reviewed on an individual basis. Reference to “Insiders” in this Code collectively refers to Permanent Insiders and Project Insiders. See Section 7, “When Can I Buy and Sell the Company’s Securities” for additional information on when you are permitted to sell securities. 5 What Kinds of Transactions are Subject to this Code? 5.1 Transactions Subject to this Code This Code applies to all transactions in the Company’s securities issued, as well as derivative securities that are not issued by the Company, such as exchange-traded put or call options or swaps relating to the Company’s securities. Accordingly, for purposes of this Code, the terms “deal,” “dealing,” “trade,” “trading” and “transactions” include not only purchases and sales of the Company’s shares in the public market but also any other purchases, sales, transfers, gifts or other acquisitions and dispositions of equity, options, warrants and other securities (including debt securities) and other arrangements or transactions that affect economic exposure to changes in the prices of these securities. 5.2 Transactions Prohibited by this Code No employee of Endava may engage in short sales, transactions in put or call options, hedging transactions, margin accounts, pledges, or other inherently speculative transactions with respect to the Company's securities. You should specify the nature of the intended transaction when submitting a Clearance Request pursuant to Section 8 below in the insider management platform provided by the Company for this purpose and the Company Secretariat will notify you if the transaction proposed is not capable of authorization on any other grounds. 6 What is Material Non-Public Information? 6.1 Material information It is not always easy to figure out whether you are aware of MNPI. But there is one important factor to determine whether non-public information you know about a public company is material: whether the information could be expected to affect the market price of that company’s securities or to be considered important by investors who are considering trading in that company’s securities. If the information makes you want to trade or deal in the company’s

Share Dealing Code Endava PLC | August 2024 6 securities, it would probably have the same effect on others. Keep in mind that both positive and negative information can be material. There is no bright-line standard for assessing materiality; rather, materiality is based on an assessment of all of the facts and circumstances and is often evaluated by relevant enforcement authorities with the benefit of hindsight. Depending on the specific details, the following items may be considered MNPI until publicly disclosed within the meaning of this Code. There may be other types of information that would qualify as material information as well; use this list merely as a non-exhaustive guide: • financial results or forecasts; • new products, features or processes; • acquisitions or dispositions of assets, divisions or companies; • public or private sales of debt or equity securities; • share splits, dividends or changes in dividend policy; • the establishment of a repurchase program for the Company’s securities; • contract awards or cancellations; • management or control changes; • employee layoffs; • a disruption in the Company’s operations or breach or unauthorized access of its property or assets, including its facilities and information technology infrastructure; • accounting restatements; • litigation or settlements; • impending bankruptcy; • gain or loss of a license agreement or other contracts with customers or suppliers; • price-sensitive projects; and • pricing changes or discount policies. 6.2 When Information is Considered Public The prohibition on dealing or trading when you have MNPI lifts once that material information becomes publicly disseminated. But for information to be considered publicly disseminated, it must be widely disseminated through a press release, a filing with the SEC, or other widely disseminated announcement. Once information is publicly disseminated, it is still necessary to afford the investing public with sufficient time to absorb the information. Generally speaking, information will be considered publicly disseminated for purposes of this Code only after two (2) full trading days have elapsed since the information was publicly disclosed. At that point, the information is considered publicly disseminated for purposes of the Code. For example, if we announce MNPI before trading begins on Wednesday, then you may execute a transaction in our securities on Friday; if we announce MNPI after trading ends on Wednesday, then you may execute a transaction in our securities on Monday. If you have questions as to whether you possess MNPI, please contact the Endava Company Secretariat team by emailing endava.co.sec@endava.com.

Share Dealing Code Endava PLC | August 2024 7 7 When Can I Buy and Sell the Company’s Securities 7.1 Generally The prohibition on dealing or trading in the Company’s securities when you have MNPI lifts once that material information becomes publicly disseminated. See Section 6.2 above. 7.2 Trading Windows for Insiders Because Insiders are most likely to have regular access to MNPI about Endava, we require them to do more than refrain from insider dealing. To minimize even the appearance of insider dealing among our Insiders, we have established “quarterly trading blackout periods” during which our Insiders and their Related Persons—regardless of whether they are aware of MNPI or not—may not conduct any trades in the Company’s securities. That means that, except as described in this Code, Insiders and their Related Persons will be able to trade in the Company’s securities only during limited open trading window periods that generally will begin after two (2) full trading days have elapsed since the public dissemination of Endava’s annual or quarterly financial results and end at the beginning of the next quarterly trading blackout period. Each open trading window will automatically close at the end of the last trading day falling two (2) calendar weeks before the end of the each fiscal period for which financial results will be released. Of course, even during an open trading window period, you may not (unless an exception applies) conduct any trades in the Company’s securities if you are otherwise in possession of MNPI. This means, for example, if the Company publishes its annual results for the year ended June 30 following the close of trading on Tuesday, September 3, you cannot buy or sell the Company's securities between Saturday, June 15 (two (2) weeks prior to the financial period end) and Thursday, September 5 (two (2) full trading days after publication of the relevant results). The trading window would reopen on Friday, September 6. The current window status can be found on www.endavainsiders.com. The Company Secretariat will send out notifications to all Insiders at the open and close of each trading window. However, the Company Secretariat cannot advise of future open window dates where the Company has not publicly announced the date of publication of financial results. You can sign up for email alerts to be alerted when the Company releases its quarterly alerts here https://investors.endava.com/news-events/email-alerts. 7.3 Event-Specific Trading Blackouts From time to time, an event or involvement in an active project may occur that is material to the Company and is known by only a few directors, executive officers and/or employees, contractors and consultants. So long as the event remains material and non-public, Project Insiders may not trade in Company’s securities. In addition, the Company's financial results may be sufficiently material in a particular financial period that, in the judgment of our Chief Executive Officer, Chief Financial Officer or Compliance Officer, no employees, contractors and consultants should trade in the Company's securities. In these situations, the open trading window may be closed early or may not open at all. In that situation, the Company Secretariat may notify the designated individuals that neither they nor their Related Persons may trade in the Company's securities. The early closing of the trading window may curtail the scheduled open trading window such that there may not be an open trading window, i.e., no ability for trades to be executed until the trading

Share Dealing Code Endava PLC | August 2024 8 window reopens. The fact that the open trading window has closed early or has not opened should be considered MNPI and should not be communicated to any other person. Exceptions will not be granted during an event-specific trading blackout. 7.4 Exceptions for Special Circumstances An Insider who believes that special circumstances require them to trade outside the open trading window should submit a dealing request form and consult with the Company Secretariat. Permission to trade outside the open trading window will only be granted where the circumstances are extenuating and there appears to be no material risk that the trade may be subsequently questioned. 8 Clearance Procedures If you are an Insider, you must not deal for yourself or for anyone else, directly or indirectly, in the Company's securities without obtaining clearance from the Company in advance. All Insiders must apply for clearance if you are buying shares on the market or selling owned shares (including those held in the Vested Share Trust Account provided by Link Group). Clearance is not required prior to placing a request to exercise vested share options via the employee portal provided by Link Group. If you are uncertain as to whether or not a particular transaction requires clearance to deal, you should obtain guidance from the Endava Company Secretariat team before carrying out that transaction by emailing endava.co.sec@endava.com. The clearance procedures are as follows: 1. Clearance Applications must be submitted through the InsiderTrack platform provided by the Company for this purpose www.endavainsiders.com. 2. You must not submit a Clearance Application if you are in possession of MNPI. If you become aware that you are or may be in possession of MNPI after you submit a Clearance Application, you must inform the Endava Company Secretariat team as soon as possible by emailing endava.co.sec@endava.com and you must refrain from dealing or trading (even if you have been given clearance to deal). 3. You will receive an electronic response to your Clearance Application, normally within two (2) business days. The Company will not normally give you reasons if you are refused permission to deal. You must keep any refusal confidential and not discuss it with any other person. 4. If you are given clearance to deal, you must deal as soon as possible and in any event within two (2) business days of receiving clearance to deal, and if you do deal you must submit a notification via the InsiderTrack platform. 5. You must not enter into, amend or cancel a trading plan or an investment program under which Company securities may be purchased or sold unless clearance to deal has been given to do so (see Trading Plan Guidelines for more information). 6. If you act as the trustee of a trust, you should seek further guidance from the Company Secretariat before dealing or trading in Company securities. You should seek further guidance from the Company Secretariat before transacting in:

Share Dealing Code Endava PLC | August 2024 9 • units or shares in a collective investment undertaking (e.g., a UCITS or an exchange traded fund) which holds, or might hold, Company securities; or • financial instruments which provide exposure to a portfolio of assets which has, or may have, an exposure to Company securities. This is the case even if you do not intend to transact in Company securities by making the relevant investment. 9 Exceptions to this Code 9.1 Exercising Vested Options Unless you are an Insider, you do not need to apply for clearance pursuant to this Code if you are exercising vested options via the online portal provided by our appointed share plan administrators. Note, however, that any subsequent sale of the shares received up the exercise of a share option will require clearance. 9.2 10b5-1 Automatic Trading Programs. Under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and as permitted by the Company, executive officers, directors and other employees as approved by the Compliance Officer from time to time may establish a trading plan under which a broker is instructed to buy and sell the Company’s securities based on pre- determined criteria (a “10b5-1 Trading Plan”). So long as a 10b5-1 Trading Plan is properly established, purchases and sales of the Company’s securities pursuant to that 10b5-1 Trading Plan are not subject to this Code. 10 Code’s Duration This Code continues to apply to your transactions in the Company’s securities and the securities of other applicable public companies as more specifically set forth in this Code, even after your relationship with Endava has ended. If you are aware of MNPI when your relationship with Endava ends, you may not deal or trade the Company’s securities or the securities of other applicable publicly traded companies until the MNPI has been publicly disseminated or is no longer material. Further, if you leave Endava during a trading blackout period, then you may not trade the Company’s securities or the securities of other applicable companies until the trading blackout period has ended. 11 Individual Responsibility Persons subject to this Code have ethical and legal obligations to maintain the confidentiality of information about Endava and to not engage in transactions in the Company’s securities or the securities of other applicable public companies while aware of MNPI, as more specifically set forth in this Code. Each individual is responsible for making sure that he or she complies with this Code, and that any family member, household member or other person or entity whose transactions are subject to this Code, as discussed under the heading “Persons Subject to This Code” above, also comply with this Code. In all cases, the responsibility for determining whether an individual is aware of MNPI rests with that individual, and any action on the part of the Company or any employee or director of the Company pursuant to this Code (or otherwise) does not in any way constitute legal advice or insulate an individual from liability under applicable securities laws. You could be subject to severe legal penalties and disciplinary action by the

Share Dealing Code Endava PLC | August 2024 10 Company for any conduct prohibited by this Code or applicable securities laws. See Section 12, “Breach of the Code” below. 12 Breach of the Code We are committed to upholding our company values in all aspects of our work. Therefore, failure to comply with this Code may result in disciplinary action, leading up to and including, termination of employment. Anyone who engages in insider dealing or otherwise violates this Code may also be subject to both civil liability and criminal penalties. Anyone who has questions about this Code should contact the Endava Company Secretariat team by emailing endava.co.sec@endava.com. 13 Governance and Oversight The Legal Team is responsible for reviewing and updating this Code annually, recommending final approval of the Code, including any revisions, to the Company’s Controls Policy Committee, followed by the Endava Board of Directors. 14 Amendments Endava is committed to continuously reviewing and updating its policies and procedures. Endava therefore reserves the right to amend, alter or terminate this Code at any time and for any reason. A current copy of the Company’s policies regarding share dealing or trading may be obtained by contacting the Endava Company Secretariat team by emailing endava.co.sec@endava.com.

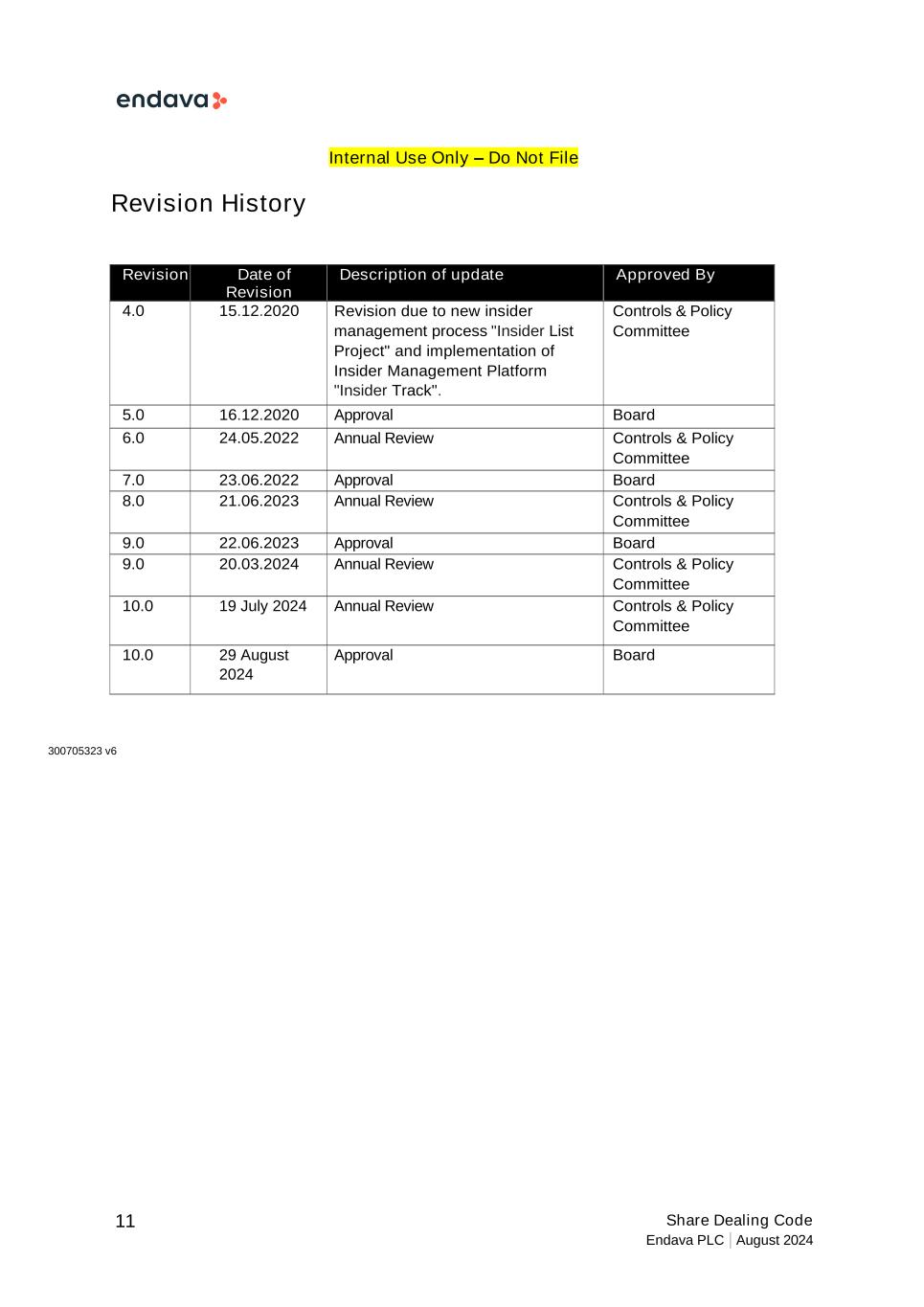

Share Dealing Code Endava PLC | August 2024 11 Internal Use Only – Do Not File Revision History Revision Date of Revision Description of update Approved By 4.0 15.12.2020 Revision due to new insider management process "Insider List Project" and implementation of Insider Management Platform "Insider Track". Controls & Policy Committee 5.0 16.12.2020 Approval Board 6.0 24.05.2022 Annual Review Controls & Policy Committee 7.0 23.06.2022 Approval Board 8.0 21.06.2023 Annual Review Controls & Policy Committee 9.0 22.06.2023 Approval Board 9.0 20.03.2024 Annual Review Controls & Policy Committee 10.0 19 July 2024 Annual Review Controls & Policy Committee 10.0 29 August 2024 Approval Board 300705323 v6