EX-99.2

Published on February 19, 2026

Q2 FY26 Investor presentation .

2 Disclaimer. This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this presentation, other than statements of historical facts, are forward-looking statements. The words “believe,” “estimate,” “expect,” “may,” “will” and similar expressions are intended to identify forward- looking statements. Such forward-looking statements include, but are not limited to, the statements regarding our business strategy and our plans and objectives for future operations, our estimated addressable market, our assumptions regarding industry trends, including with respect to AI,potential technological disruptions, and client demand for our services. Forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements, including, but not limited to: our ability to achieve its revenue growth goals including as a result of a slower conversion of its pipeline; our expectations of future operating results or financial performance; our ability to accurately forecast and achieve its announced guidance; our ability to retain existing clients and attract new clients, including its ability to increase revenue from existing clients and diversify its revenue concentration; our ability to attract and retain highly-skilled IT professionals at cost-effective rates; our ability to successfully identify acquisition targets, consummate acquisitions and successfully integrate acquired businesses and personnel; our ability to penetrate new industry verticals and geographies and grow its revenue in current industry verticals and geographies; our ability to maintain favourable pricing and utilisation rates to support its gross margin; the effects of increased competition as well as innovations by new and existing competitors in its market; the size of our addressable market and market trends; our ability to adapt to technological change and industry trends and innovate solutions for its clients; our plans for growth and future operations, including its ability to manage its growth; our ability to effectively manage its international operations, including our exposure to foreign currency exchange rate fluctuations; our future financial performance; the impact of unstable market, economic and global conditions, as well as other risks and uncertainties discussed in the “Risk Factors” section of our Annual Report on Form 20-F for the year ended June 30, 2025 filed with the SEC on September 4, 2025 and in other filings that we make from time to time with the SEC. Except as required by law, we assume no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements contained in this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. By attending or receiving this presentation you acknowledge that you will be solely responsible for your own assessment of the market and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of our business. This presentation includes non-IFRS financial measures which have certain limitations and should not be considered in isolation, or as alternatives to or substitutes for, financial measures determined in accordance with IFRS. The non-IFRS measures as defined by us may not be comparable to similar non-IFRS measures presented by other companies. Our presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that our future results will be unaffected by these or other unusual or non-recurring items. See the IFRS to Non-IFRS Reconciliation section for a reconciliation of these non-IFRS financial measures to the most directly comparable IFRS financial measures.

About Endava.

© Copyright 2023 Endava • Confidential and Proprietary • Version 1.0 4 We are a technology services company built for ongoing change. Endava supports clients in adapting to dynamic market demands through human ingenuity, intelligent systems and deep delivery expertise. We embed modern technologies - including AI - into the heart of our clients’ operations to deliver measurable outcomes and improved competitive advantage.

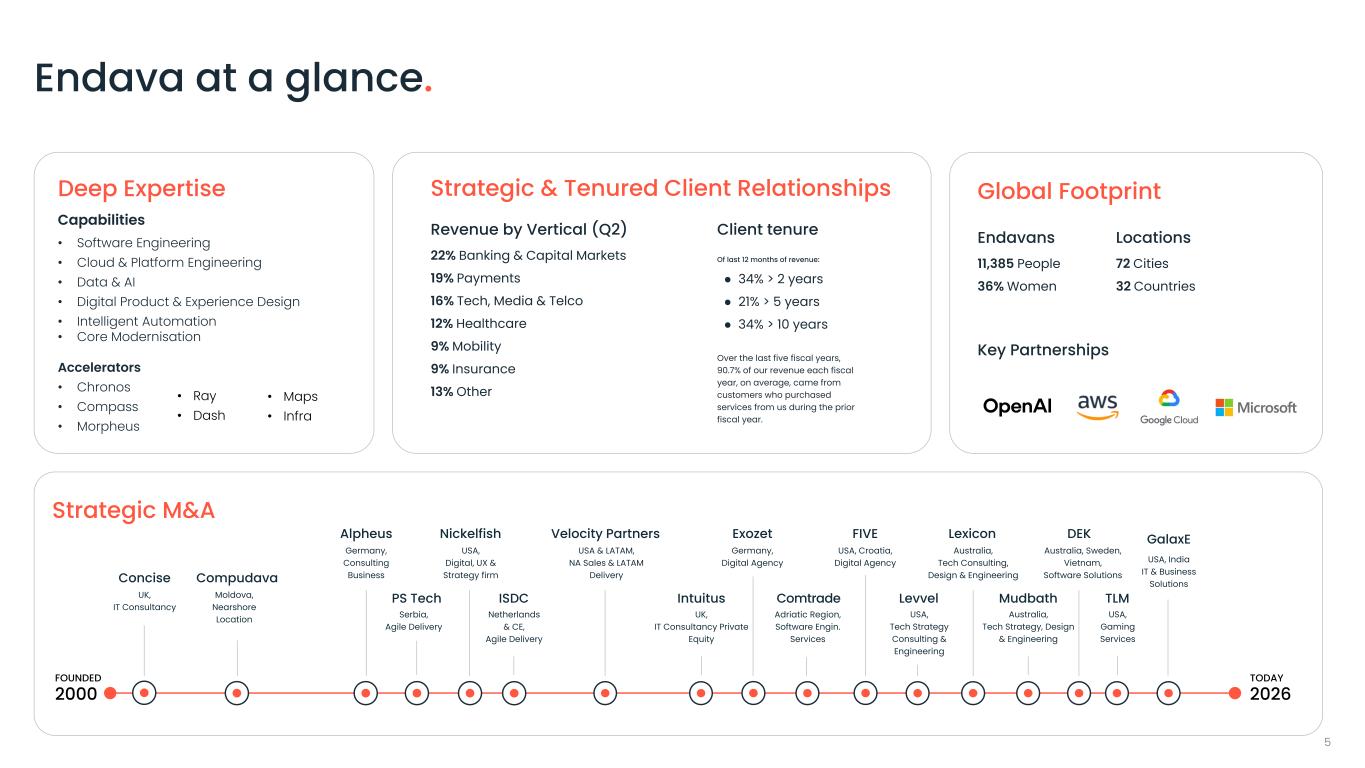

5 Endava at a glance .. Revenue by Vertical (Q2) 22% Banking & Capital Markets 19% Payments 16% Tech, Media & Telco 12% Healthcare 9% Mobility 9% Insurance 13% Other Capabilities • Software Engineering • Cloud & Platform Engineering • Data & AI • Digital Product & Experience Design • Intelligent Automation • Core Modernisation Accelerators • Chronos • Compass • Morpheus Concise UK, IT Consultancy Compudava Moldova, Nearshore Location Alpheus Germany, Consulting Business Nickelfish USA, Digital, UX & Strategy firm Velocity Partners USA & LATAM, NA Sales & LATAM Delivery PS Tech Serbia, Agile Delivery ISDC Netherlands & CE, Agile Delivery Intuitus UK, IT Consultancy Private Equity Exozet Germany, Digital Agency Comtrade Adriatic Region, Software Engin. Services FIVE USA, Croatia, Digital Agency Levvel USA, Tech Strategy Consulting & Engineering Lexicon Australia, Tech Consulting, Design & Engineering Mudbath Australia, Tech Strategy, Design & Engineering Australia, Sweden, Vietnam, Software Solutions DEK TLM USA, Gaming Services GalaxE USA, India IT & Business Solutions • Ray • Dash Deep Expertise Strategic & Tenured Client Relationships Client tenure Of last 12 months of revenue: ● 34% > 2 years ● 21% > 5 years ● 34% > 10 years Over the last five fiscal years, 90.7% of our revenue each fiscal year, on average, came from customers who purchased services from us during the prior fiscal year. Global Footprint • Maps • Infra Endavans 11,385 People 36% Women Locations 72 Cities 32 Countries Key Partnerships FOUNDED 2000 TODAY 2026 Strategic M&A

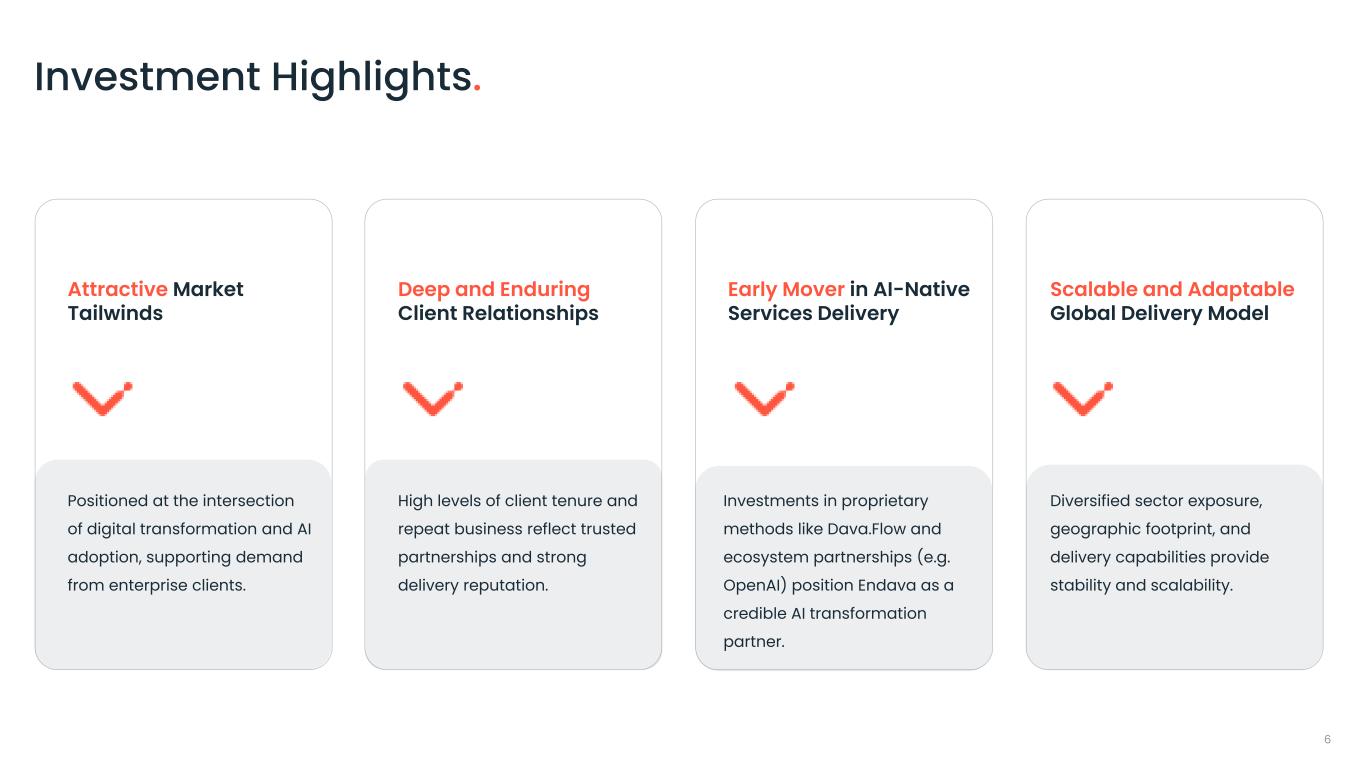

6 Positioned at the intersection of digital transformation and AI adoption, supporting demand from enterprise clients. High levels of client tenure and repeat business reflect trusted partnerships and strong delivery reputation. Investments in proprietary methods like Dava.Flow and ecosystem partnerships (e.g. OpenAI) position Endava as a credible AI transformation partner. Diversified sector exposure, geographic footprint, and delivery capabilities provide stability and scalability. Investment Highlights . Early Mover in AI-Native Services Delivery Scalable and Adaptable Global Delivery Model Deep and Enduring Client Relationships Attractive Market Tailwinds

7 >25 years navigating digital shifts . For over 25 years we’ve been helping our customers transform people’s lives through technology. Businesses rely on Endava as a trusted partner to harness emerging technologies, modernise operations and digitise customer interactions. Successive Waves of Tech-Enabled Change for Enterprise: • What is technologically possible • The way work flows and how it is governed and managed • Accountability and quality • Deep domain expertise and problem-solving What has changed? What has never changed? 2000 The Internet & Distributed Systems Shift 2010 The Digital Transformation Shift Today The AI-Native Shift

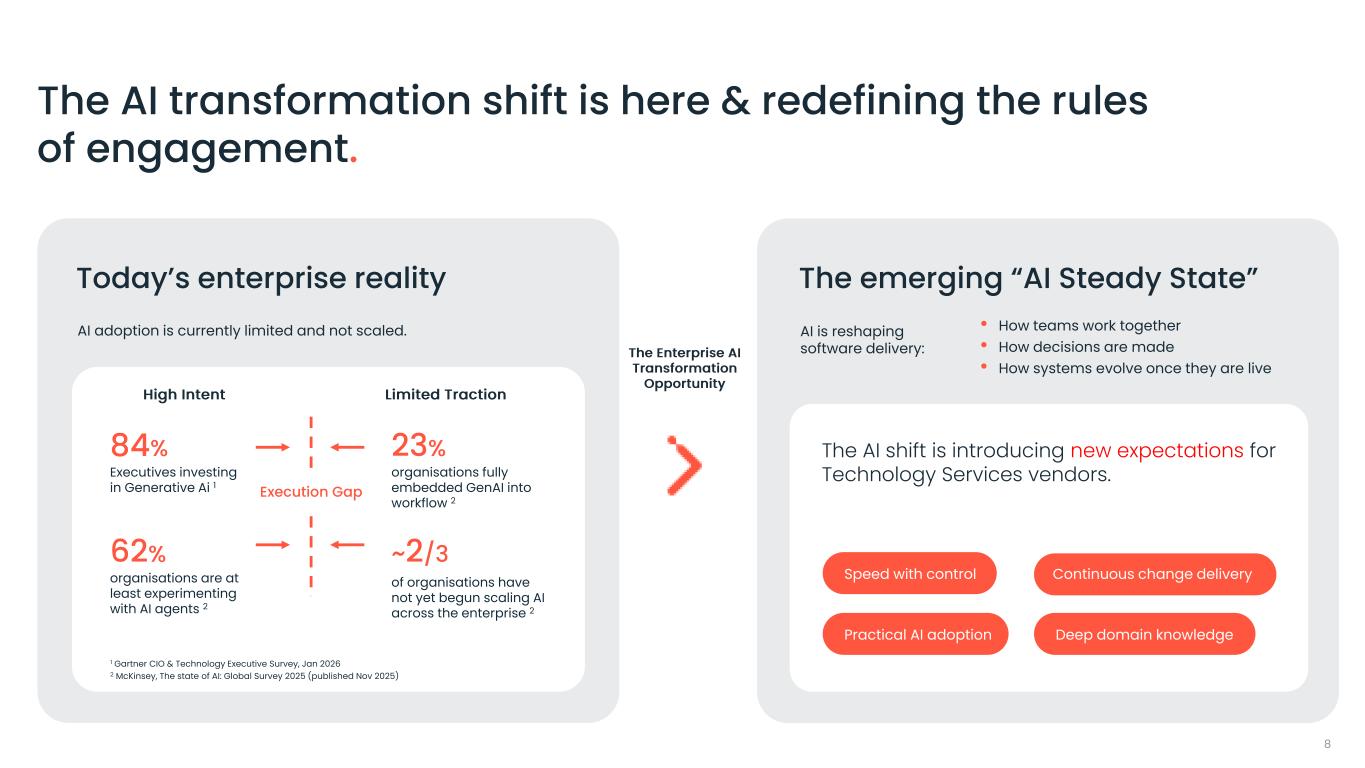

8 The AI transformation shift is here & redefining the rules of engagement . The Enterprise AI Transformation Opportunity Today’s enterprise reality AI adoption is currently limited and not scaled. The emerging “AI Steady State” AI is reshaping software delivery: 62% organisations are at least experimenting with AI agents 2 ~2/3 of organisations have not yet begun scaling AI across the enterprise 2 23% organisations fully embedded GenAI into workflow 2 84% Executives investing in Generative Ai 1 Execution Gap High Intent Limited Traction • How teams work together • How decisions are made • How systems evolve once they are live The AI shift is introducing new expectations for Technology Services vendors. Speed with control Practical AI adoption Continuous change delivery Deep domain knowledge 1 Gartner CIO & Technology Executive Survey, Jan 2026 2 McKinsey, The state of AI: Global Survey 2025 (published Nov 2025)

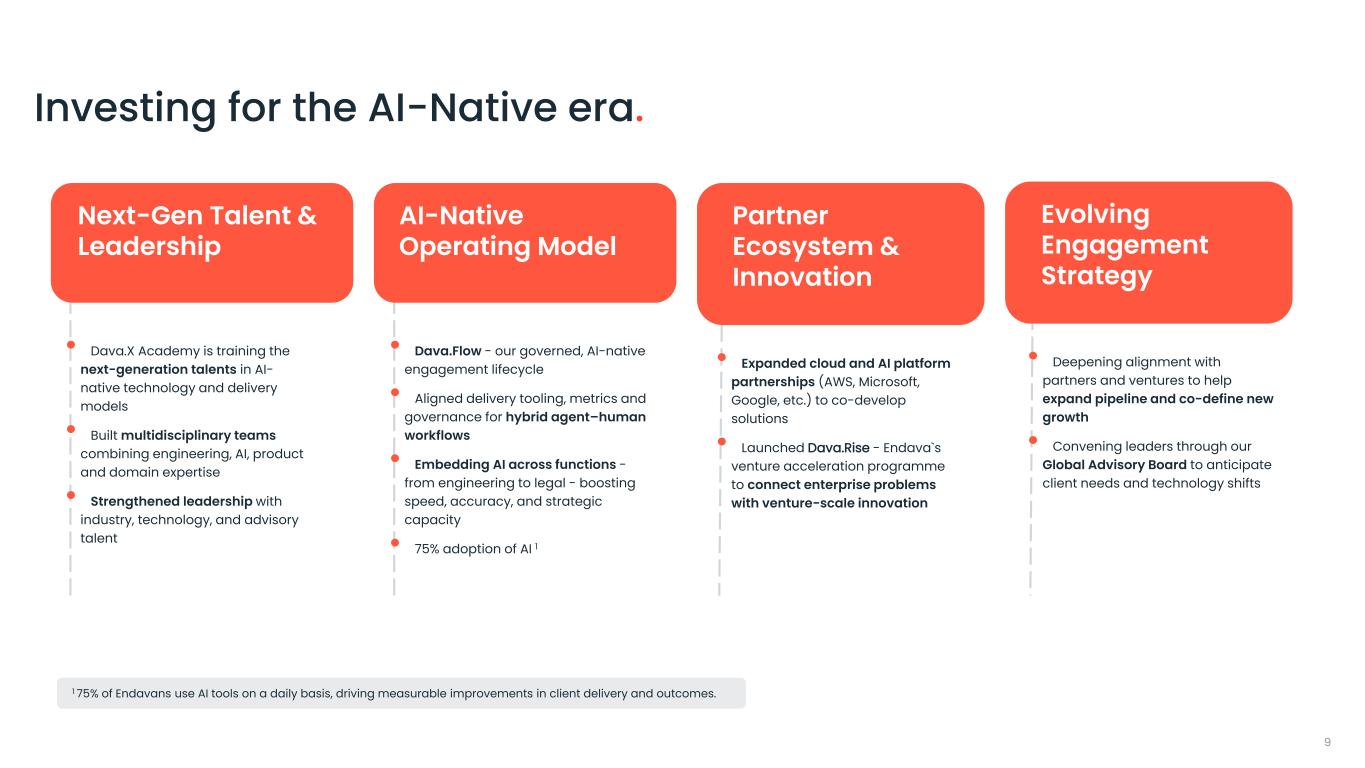

• Dava.X Academy is training the next-generation talents in AI- native technology and delivery models • Built multidisciplinary teams combining engineering, AI, product and domain expertise • Strengthened leadership with industry, technology, and advisory talent Next-Gen Talent & Leadership • Dava.Flow - our governed, AI-native engagement lifecycle • Aligned delivery tooling, metrics and governance for hybrid agent–human workflows • Embedding AI across functions - from engineering to legal - boosting speed, accuracy, and strategic capacity • 75% adoption of AI 1 AI-Native Operating Model • Expanded cloud and AI platform partnerships (AWS, Microsoft, Google, etc.) to co-develop solutions • Launched Dava.Rise - Endava`s venture acceleration programme to connect enterprise problems with venture-scale innovation Partner Ecosystem & Innovation • Deepening alignment with partners and ventures to help expand pipeline and co-define new growth • Convening leaders through our Global Advisory Board to anticipate client needs and technology shifts Evolving Engagement Strategy Investing for the AI - Native era . 9 1 75% of Endavans use AI tools on a daily basis, driving measurable improvements in client delivery and outcomes.

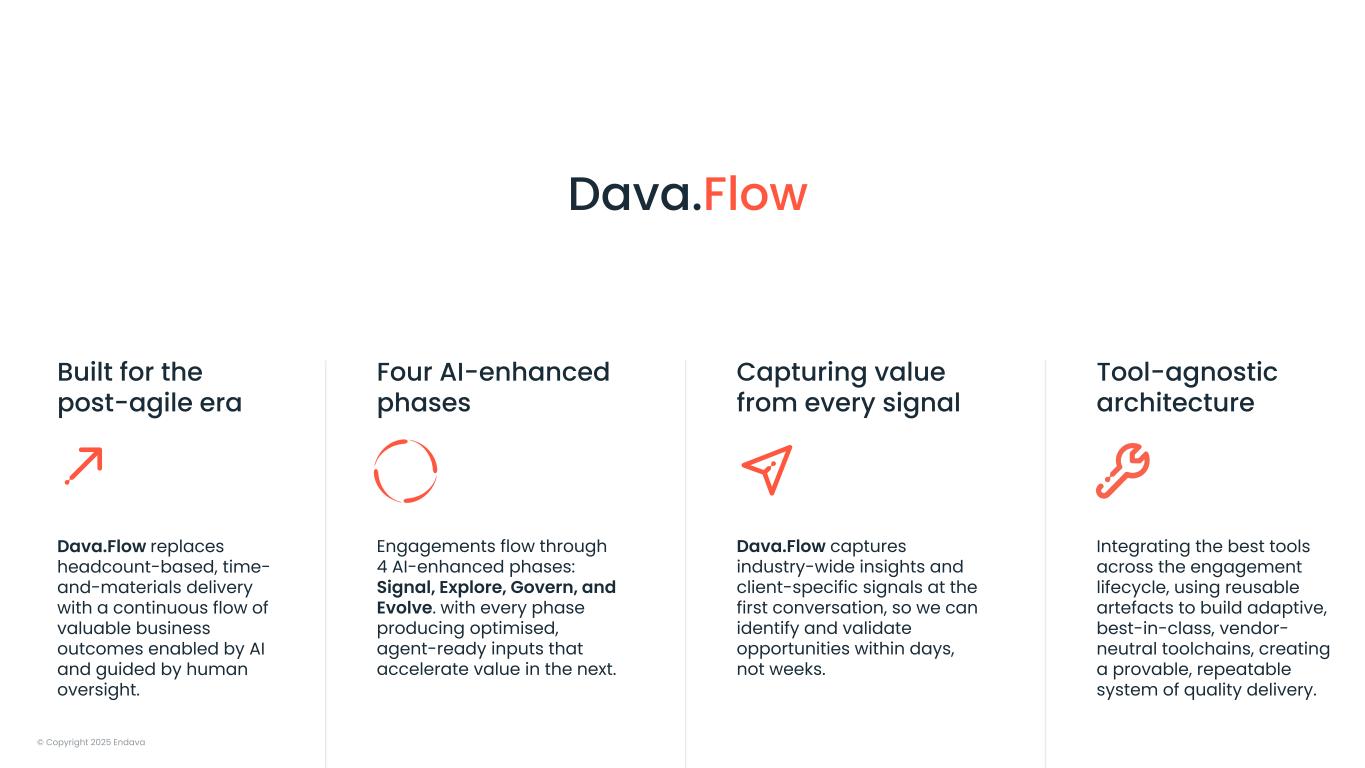

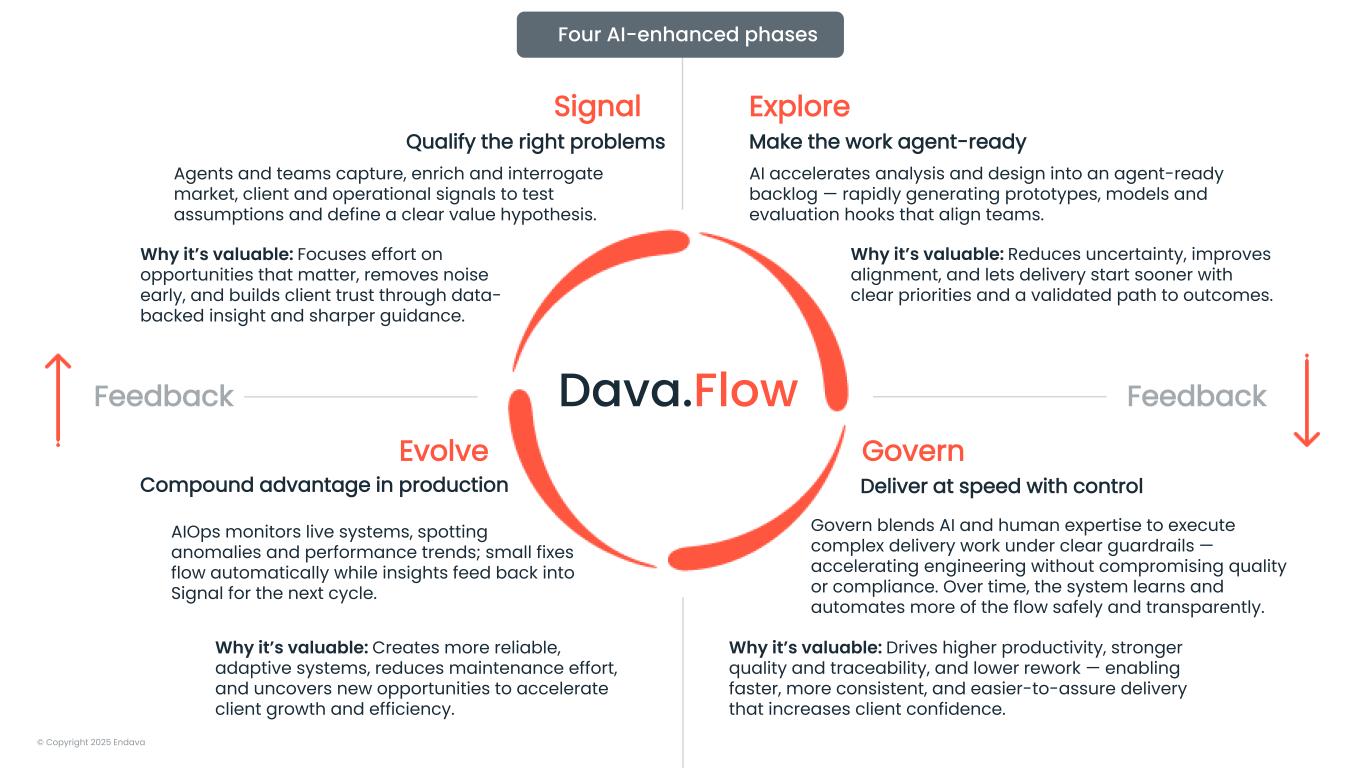

© Copyright 2025 Endava Dava.Flow Built for the post-agile era Four AI-enhanced phases Capturing value from every signal Tool-agnostic architecture Dava.Flow replaces headcount-based, time- and-materials delivery with a continuous flow of valuable business outcomes enabled by AI and guided by human oversight. Engagements flow through 4 AI-enhanced phases: Signal, Explore, Govern, and Evolve. with every phase producing optimised, agent-ready inputs that accelerate value in the next. Dava.Flow captures industry-wide insights and client-specific signals at the first conversation, so we can identify and validate opportunities within days, not weeks. Integrating the best tools across the engagement lifecycle, using reusable artefacts to build adaptive, best-in-class, vendor- neutral toolchains, creating a provable, repeatable system of quality delivery.

© Copyright 2025 Endava Dava.Flow Four AI-enhanced phases AI accelerates analysis and design into an agent-ready backlog — rapidly generating prototypes, models and evaluation hooks that align teams. Explore Make the work agent-ready Why it’s valuable: Reduces uncertainty, improves alignment, and lets delivery start sooner with clear priorities and a validated path to outcomes. Feedback AIOps monitors live systems, spotting anomalies and performance trends; small fixes flow automatically while insights feed back into Signal for the next cycle. Evolve Compound advantage in production Why it’s valuable: Creates more reliable, adaptive systems, reduces maintenance effort, and uncovers new opportunities to accelerate client growth and efficiency. Agents and teams capture, enrich and interrogate market, client and operational signals to test assumptions and define a clear value hypothesis. Signal Qualify the right problems Why it’s valuable: Focuses effort on opportunities that matter, removes noise early, and builds client trust through data- backed insight and sharper guidance. Feedback Govern blends AI and human expertise to execute complex delivery work under clear guardrails — accelerating engineering without compromising quality or compliance. Over time, the system learns and automates more of the flow safely and transparently. Govern Deliver at speed with control Why it’s valuable: Drives higher productivity, stronger quality and traceability, and lower rework — enabling faster, more consistent, and easier-to-assure delivery that increases client confidence.

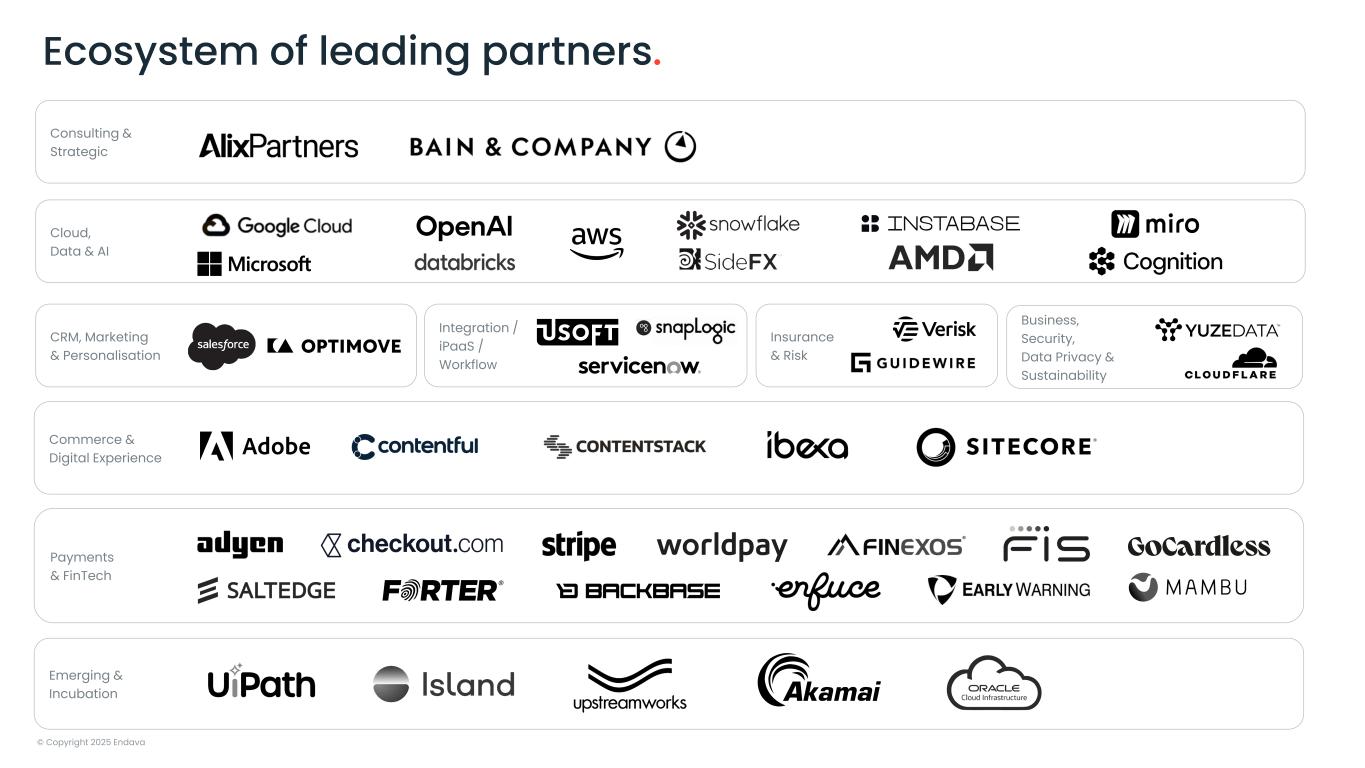

© Copyright 2025 Endava Cloud, Data & AI Consulting & Strategic Commerce & Digital Experience CRM, Marketing & Personalisation Integration / iPaaS / Workflow Insurance & Risk Business, Security, Data Privacy & Sustainability Payments & FinTech Emerging & Incubation Ecosystem of leading partners .

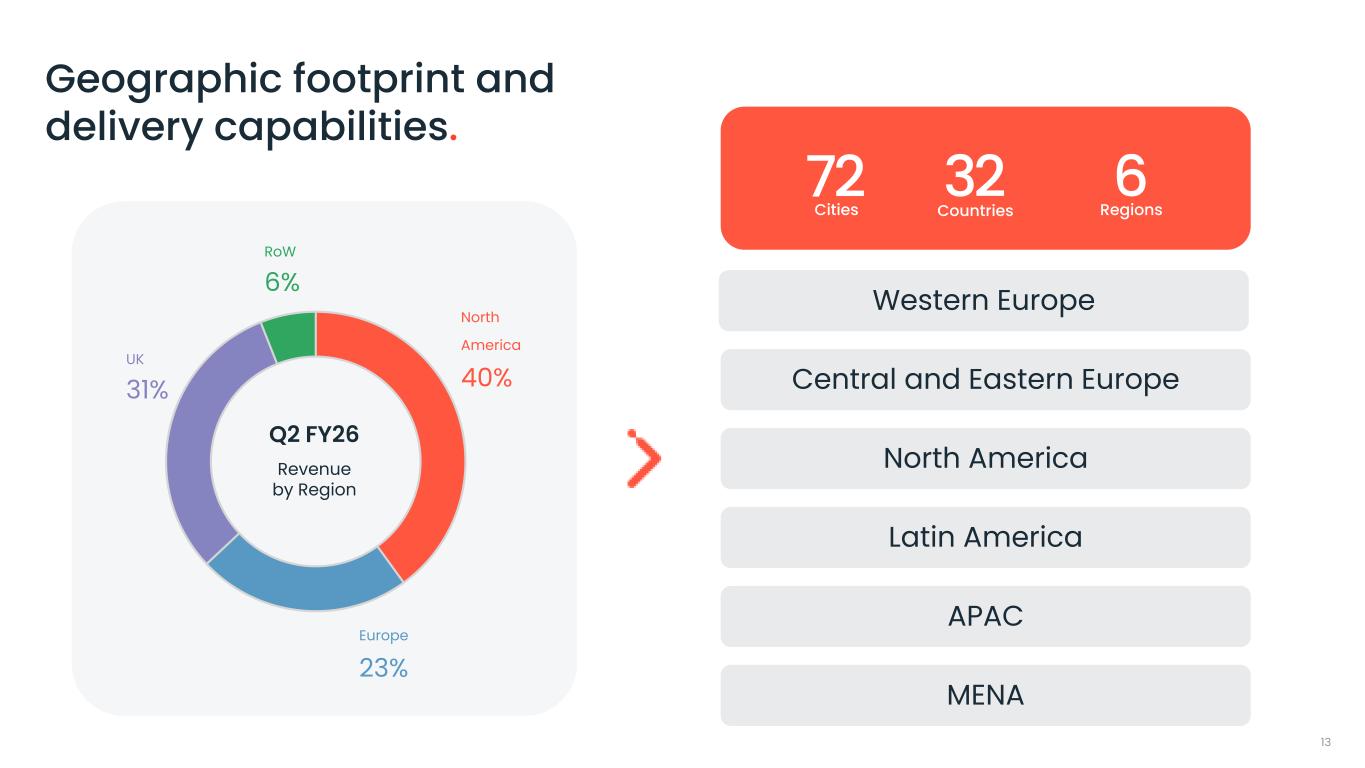

72 632 Cities Countries Regions 13 Geographic footprint and delivery capabilities . Western Europe Central and Eastern Europe North America Latin America APAC MENA North America 40% Europe 23% UK 31% RoW 6% Q2 FY26 Revenue by Region

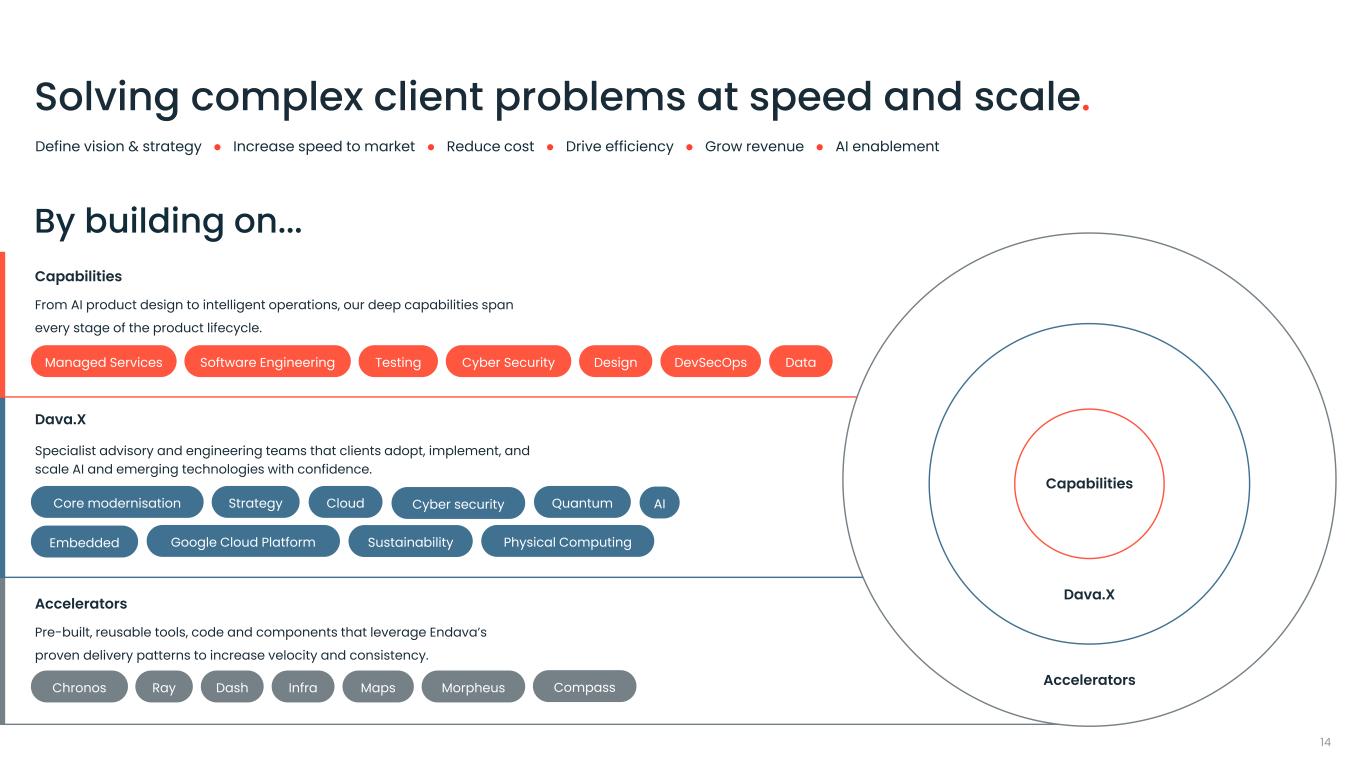

14 Solving complex client problems at speed and scale . By building on... Define vision & strategy ● Increase speed to market ● Reduce cost ● Drive efficiency ● Grow revenue ● AI enablement Capabilities Dava.X Accelerators Chronos Ray Dash MorpheusInfra Maps Compass Accelerators Pre-built, reusable tools, code and components that leverage Endava’s proven delivery patterns to increase velocity and consistency. Core modernisation Strategy Embedded Google Cloud Platform Sustainability Cloud AICyber security Physical Computing Quantum Dava.X Specialist advisory and engineering teams that clients adopt, implement, and scale AI and emerging technologies with confidence. Managed Services DevSecOpsTesting Cyber SecuritySoftware Engineering Design Data Capabilities From AI product design to intelligent operations, our deep capabilities span every stage of the product lifecycle.

Q2 ‘26 Financial Highlights.

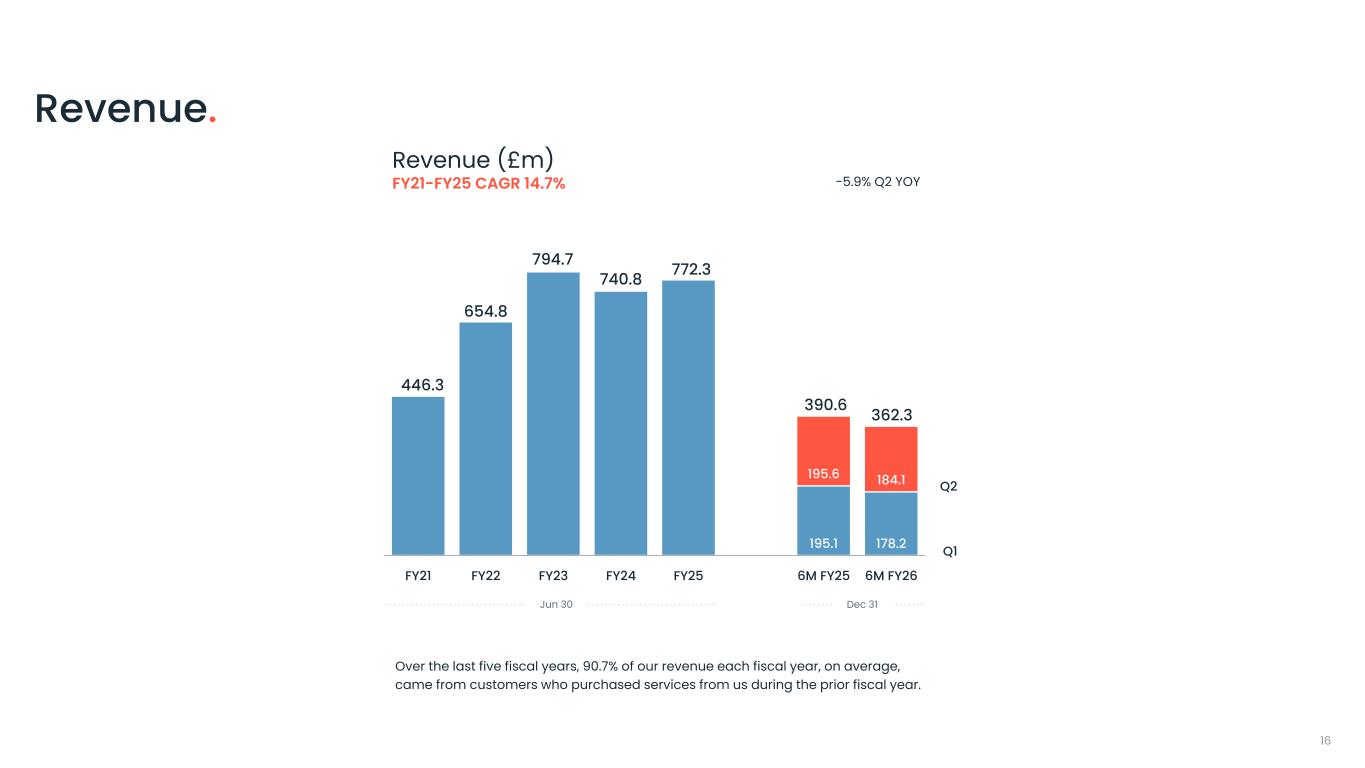

16 Revenue .. 195.1 178.2 195.6 184.1 446.3 654.8 794.7 740.8 772.3 390.6 362.3 FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 FY21-FY25 CAGR 14.7% Over the last five fiscal years, 90.7% of our revenue each fiscal year, on average, came from customers who purchased services from us during the prior fiscal year. -5.9% Q2 YOY Revenue (£m) Q1 Jun 30 Dec 31 Q2

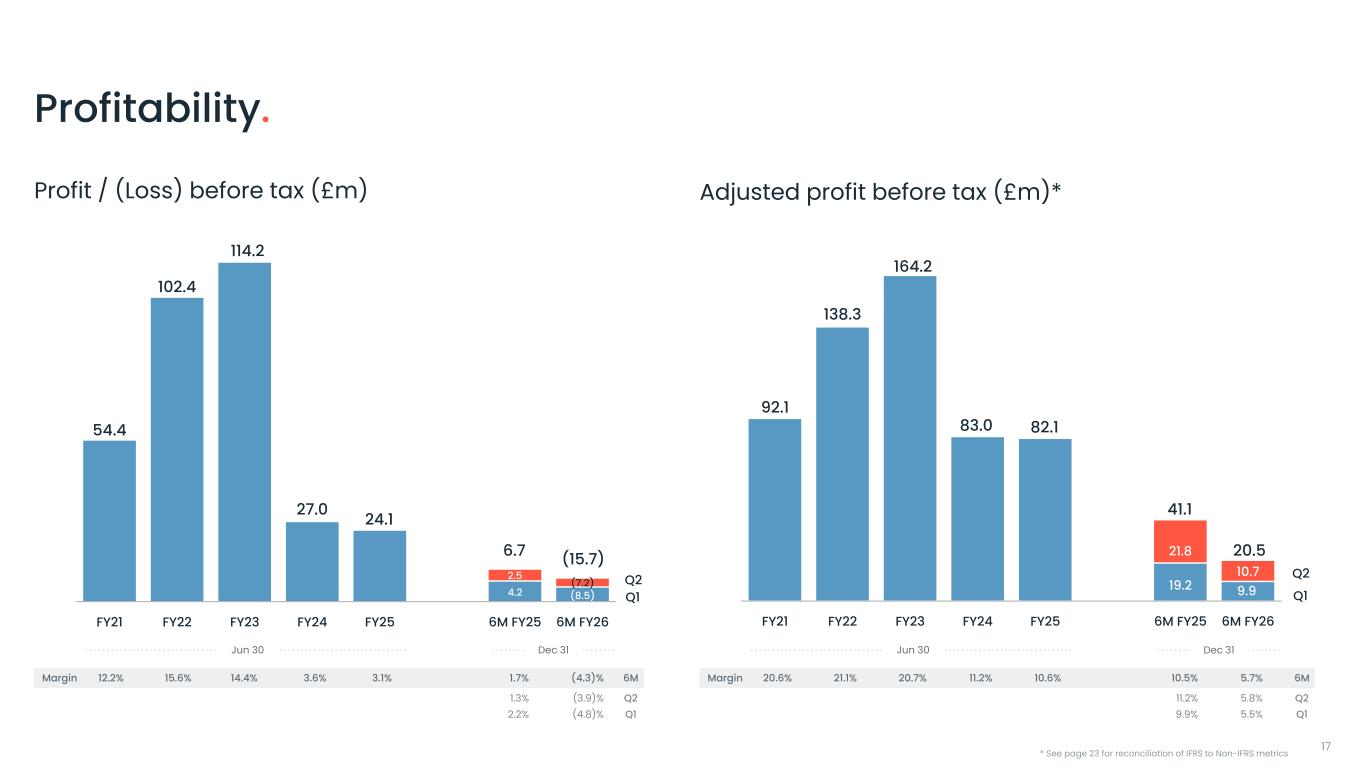

54.4 102.4 114.2 27.0 24.1 6.7 (15.7) 2.5 (7.2) 4.2 (8.5) FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Profit / (Loss) before tax (£m) Jun 30 Dec 31 12.2% 15.6% 14.4% 3.6% 3.1% 1.7% (4.3)% 6MMargin 92.1 138.3 164.2 83.0 82.1 41.1 20.521.8 10.7 19.2 9.9 FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Adjusted profit before tax (£m)* Q1 Jun 30 Dec 31 Margin 20.6% 21.1% 20.7% 11.2% 10.6% 10.5% 5.7% 6M * See page 23 for reconciliation of IFRS to Non-IFRS metrics 17 Q1 Profitability .. Q2 Q2

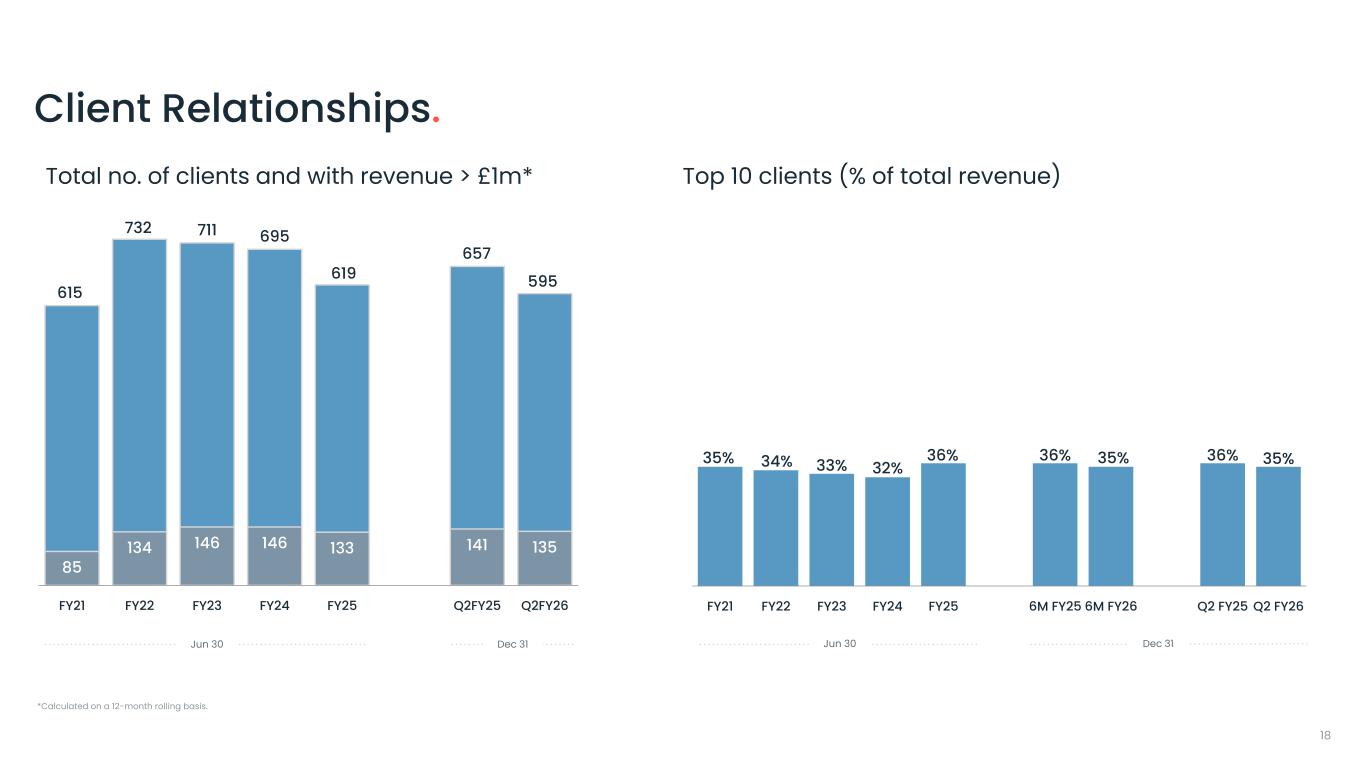

85 134 146 146 133 141 135 615 732 711 695 619 657 595 FY21 FY22 FY23 FY24 FY25 Q2FY25 Q2FY26 Total no. of clients and with revenue > £1m* Dec 31Jun 30 Dec 31 Top 10 clients (% of total revenue) 18 *Calculated on a 12-month rolling basis. Client Relationships .. 35% 34% 33% 32% 36% 36% 35% 36% 35% FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Q2 FY25 Q2 FY26 Jun 30

15.6 22.2 26.0 24.1 27.9 14.1 12.8 7.1 6.5 FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Q2FY25 Q2FY26 19 Top 10 clients - average spend (£m) 0.70 0.84 0.91 0.79 0.84 0.52 0.53 0.29 0.30 FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Q2FY25 Q2FY26 Jun 30 Dec 31Jun 30 Dec 31 Remaining clients - average spend (£m) Clients Spend ..

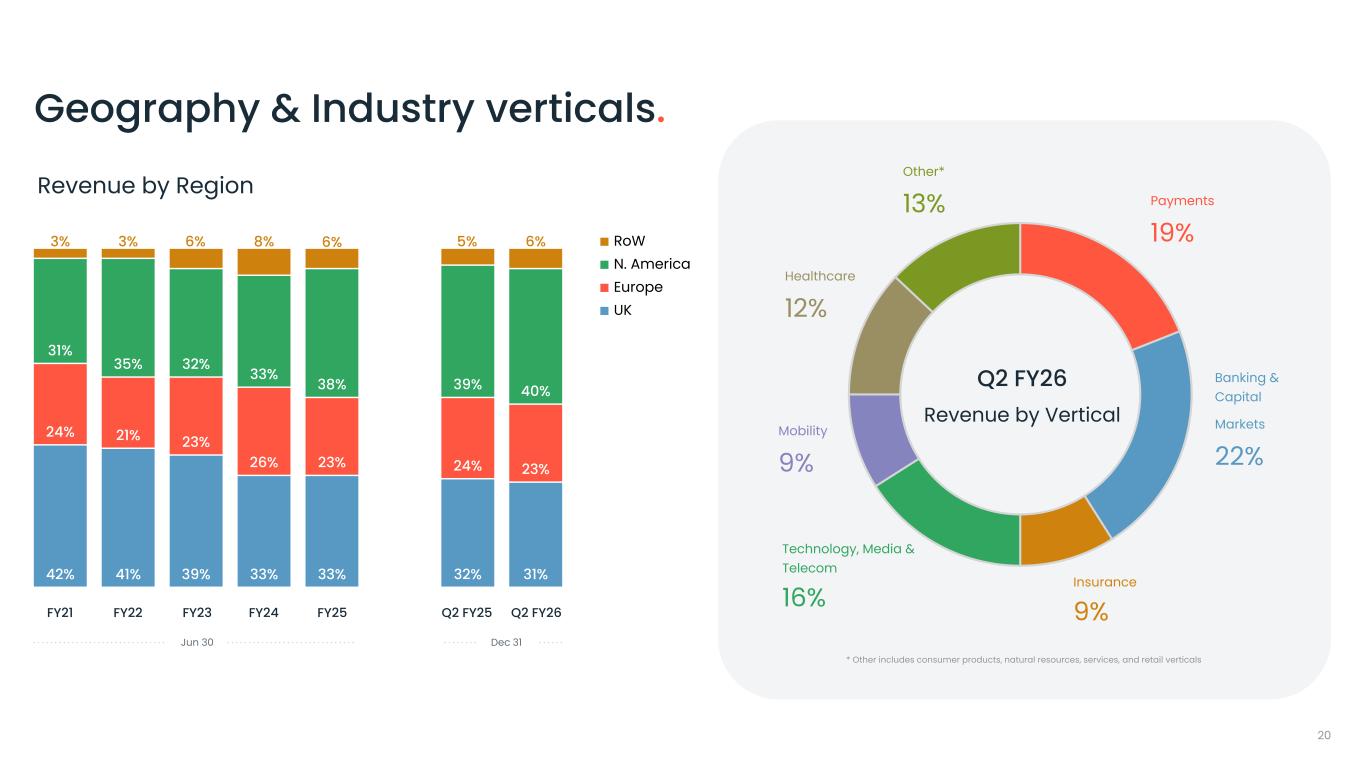

42% 41% 39% 33% 33% 32% 31% 24% 21% 23% 26% 23% 24% 23% 31% 35% 32% 33% 38% 39% 40% 3% 3% 6% 8% 6% 5% 6% RoW N. America Europe UK Payments 19% Banking & Capital Markets 22% Insurance 9% Technology, Media & Telecom 16% Mobility 9% Healthcare 12% Other* 13% * Other includes consumer products, natural resources, services, and retail verticals Q2 FY26 Revenue by Vertical FY21 Jun 30 Q2 FY25 Q2 FY26FY22 FY23 FY24 FY25 Dec 31 Revenue by Region 20 Geography & Industry verticals ..

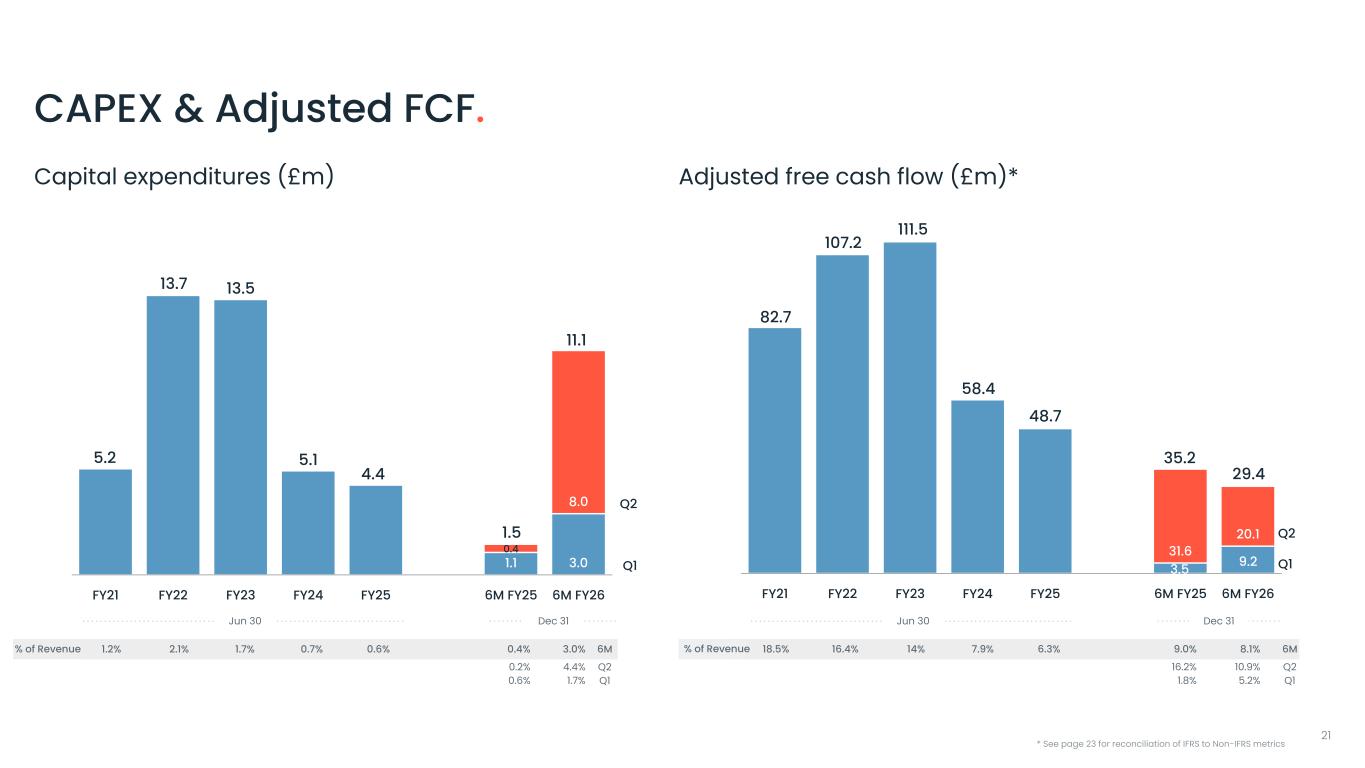

1.1 3.0 0.4 8.0 5.2 13.7 13.5 5.1 4.4 1.5 11.1 FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Capital expenditures (£m) Jun 30 Dec 31 1.2% 2.1% 1.7% 0.7% 0.6% 0.4% 3.0% 6M 0.2% 4.4% Q2 0.6% 1.7% Q1 % of Revenue 82.7 107.2 111.5 58.4 48.7 3.5 9.2 31.6 20.1 35.2 29.4 FY21 FY22 FY23 FY24 FY25 6M FY25 6M FY26 Adjusted free cash flow (£m)* Q1 Jun 30 Dec 31 18.5% 16.4% 14% 7.9% 6.3% 9.0% 8.1% 6M 16.2% 10.9% Q2 1.8% 5.2% Q1 * See page 23 for reconciliation of IFRS to Non-IFRS metrics % of Revenue 21 Q1 CAPEX & Adjusted FCF .. Q2 Q2

Appendix

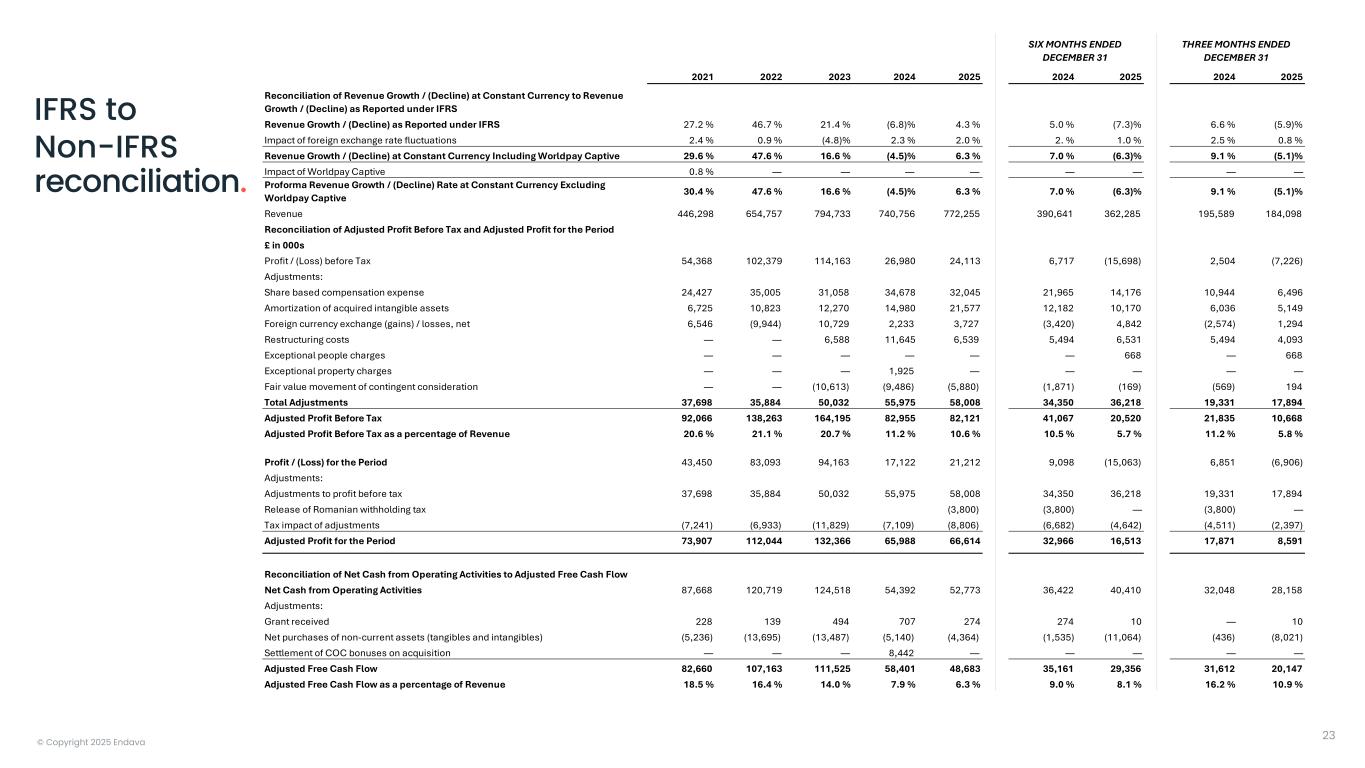

© Copyright 2025 Endava IFRS to Non-IFRS reconciliation. 23 2021 2022 2023 2024 2025 2024 2025 2024 2025 Reconciliation of Revenue Growth / (Decline) at Constant Currency to Revenue Growth / (Decline) as Reported under IFRS Revenue Growth / (Decline) as Reported under IFRS 27.2 % 46.7 % 21.4 % (6.8)% 4.3 % 5.0 % (7.3)% 6.6 % (5.9)% Impact of foreign exchange rate fluctuations 2.4 % 0.9 % (4.8)% 2.3 % 2.0 % 2. % 1.0 % 2.5 % 0.8 % Revenue Growth / (Decline) at Constant Currency Including Worldpay Captive 29.6 % 47.6 % 16.6 % (4.5)% 6.3 % 7.0 % (6.3)% 9.1 % (5.1)% Impact of Worldpay Captive 0.8 % — — — — — — — — Proforma Revenue Growth / (Decline) Rate at Constant Currency Excluding Worldpay Captive 30.4 % 47.6 % 16.6 % (4.5)% 6.3 % 7.0 % (6.3)% 9.1 % (5.1)% Revenue 446,298 654,757 794,733 740,756 772,255 390,641 362,285 195,589 184,098 Reconciliation of Adjusted Profit Before Tax and Adjusted Profit for the Period £ in 000s Profit / (Loss) before Tax 54,368 102,379 114,163 26,980 24,113 6,717 (15,698) 2,504 (7,226) Adjustments: Share based compensation expense 24,427 35,005 31,058 34,678 32,045 21,965 14,176 10,944 6,496 Amortization of acquired intangible assets 6,725 10,823 12,270 14,980 21,577 12,182 10,170 6,036 5,149 Foreign currency exchange (gains) / losses, net 6,546 (9,944) 10,729 2,233 3,727 (3,420) 4,842 (2,574) 1,294 Restructuring costs — — 6,588 11,645 6,539 5,494 6,531 5,494 4,093 Exceptional people charges — — — — — — 668 — 668 Exceptional property charges — — — 1,925 — — — — — Fair value movement of contingent consideration — — (10,613) (9,486) (5,880) (1,871) (169) (569) 194 Total Adjustments 37,698 35,884 50,032 55,975 58,008 34,350 36,218 19,331 17,894 Adjusted Profit Before Tax 92,066 138,263 164,195 82,955 82,121 41,067 20,520 21,835 10,668 Adjusted Profit Before Tax as a percentage of Revenue 20.6 % 21.1 % 20.7 % 11.2 % 10.6 % 10.5 % 5.7 % 11.2 % 5.8 % Profit / (Loss) for the Period 43,450 83,093 94,163 17,122 21,212 9,098 (15,063) 6,851 (6,906) Adjustments: Adjustments to profit before tax 37,698 35,884 50,032 55,975 58,008 34,350 36,218 19,331 17,894 Release of Romanian withholding tax (3,800) (3,800) — (3,800) — Tax impact of adjustments (7,241) (6,933) (11,829) (7,109) (8,806) (6,682) (4,642) (4,511) (2,397) Adjusted Profit for the Period 73,907 112,044 132,366 65,988 66,614 32,966 16,513 17,871 8,591 Reconciliation of Net Cash from Operating Activities to Adjusted Free Cash Flow Net Cash from Operating Activities 87,668 120,719 124,518 54,392 52,773 36,422 40,410 32,048 28,158 Adjustments: Grant received 228 139 494 707 274 274 10 — 10 Net purchases of non-current assets (tangibles and intangibles) (5,236) (13,695) (13,487) (5,140) (4,364) (1,535) (11,064) (436) (8,021) Settlement of COC bonuses on acquisition — — — 8,442 — — — — — Adjusted Free Cash Flow 82,660 107,163 111,525 58,401 48,683 35,161 29,356 31,612 20,147 Adjusted Free Cash Flow as a percentage of Revenue 18.5 % 16.4 % 14.0 % 7.9 % 6.3 % 9.0 % 8.1 % 16.2 % 10.9 % SIX MONTHS ENDED DECEMBER 31 THREE MONTHS ENDED DECEMBER 31