EX-99.2

Published on November 12, 2020

INVESTOR PRESENTATION Q1 FY2021

Disclaimer This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this presentation, other than statements of historical facts, are forward-looking statements. The words “believe,” “estimate,” “expect,” “may,” “will” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, the statements regarding the impact of the COVID-19 pandemic and associated global economic uncertainty on demand for our technology services, our business strategy and our plans and objectives for future operations, our addressable market, potential technological disruptions, and client demand for our services. Forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements, including, but not limited to: our business, results of operations and financial condition may be negatively impacted by the COVID-19 pandemic and the precautions taken in response to the pandemic or if general economic conditions in Europe, the United States or the global economy worsen; our ability to manage our rapid growth or achieve anticipated growth; our ability to retain existing clients and attract new clients, including our ability to increase revenue from existing clients and diversify our revenue concentration; our ability to attract and retain highly-skilled IT professionals at cost-effective rates; our ability to penetrate new industry verticals and geographies and grow our revenue in current industry verticals and geographies; our ability to maintain favourable pricing and utilisation rates; our ability to successfully identify acquisition targets, consummate acquisitions and successfully integrate acquired businesses and personnel; the effects of increased competition as well as innovations by new and existing competitors in our market; our ability to adapt to technological change and innovate solutions for our clients; our ability to collect on billed and unbilled receivables from clients; our ability to effectively manage our international operations, including our exposure to foreign currency exchange rate fluctuations; our ability to remediate the identified material weaknesses and maintain an effective system of disclosure controls and internal control over financial reporting and our future financial performance, including trends in revenue, cost of sales, gross profit, selling, general and administrative expenses, finance income and expense and taxes, as well as other risks and uncertainties discussed in the “Risk Factors” section of our Annual Report on Form 20-F filed with the Securities and Exchange Commission (the “SEC”) on September 15, 2020. Except as required by law, we assume no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements contained in this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. By attending or receiving this presentation you acknowledge that you will be solely responsible for your own assessment of the market and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of our business. This presentation includes non-IFRS financial measures which have certain limitations and should not be considered in isolation, or as alternatives to or substitutes for, financial measures determined in accordance with IFRS. The non-IFRS measures as defined by us may not be comparable to similar non-IFRS measures presented by other companies. Our presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that our future results will be unaffected by these or other unusual or non-recurring items. See the IFRS to Non-IFRS Reconciliation section for a reconciliation of these non-IFRS financial measures to the most directly comparable IFRS financial measures. 2

REIMAGINING THE RELATIONSHIP BETWEEN PEOPLE & TECHNOLOGY 3

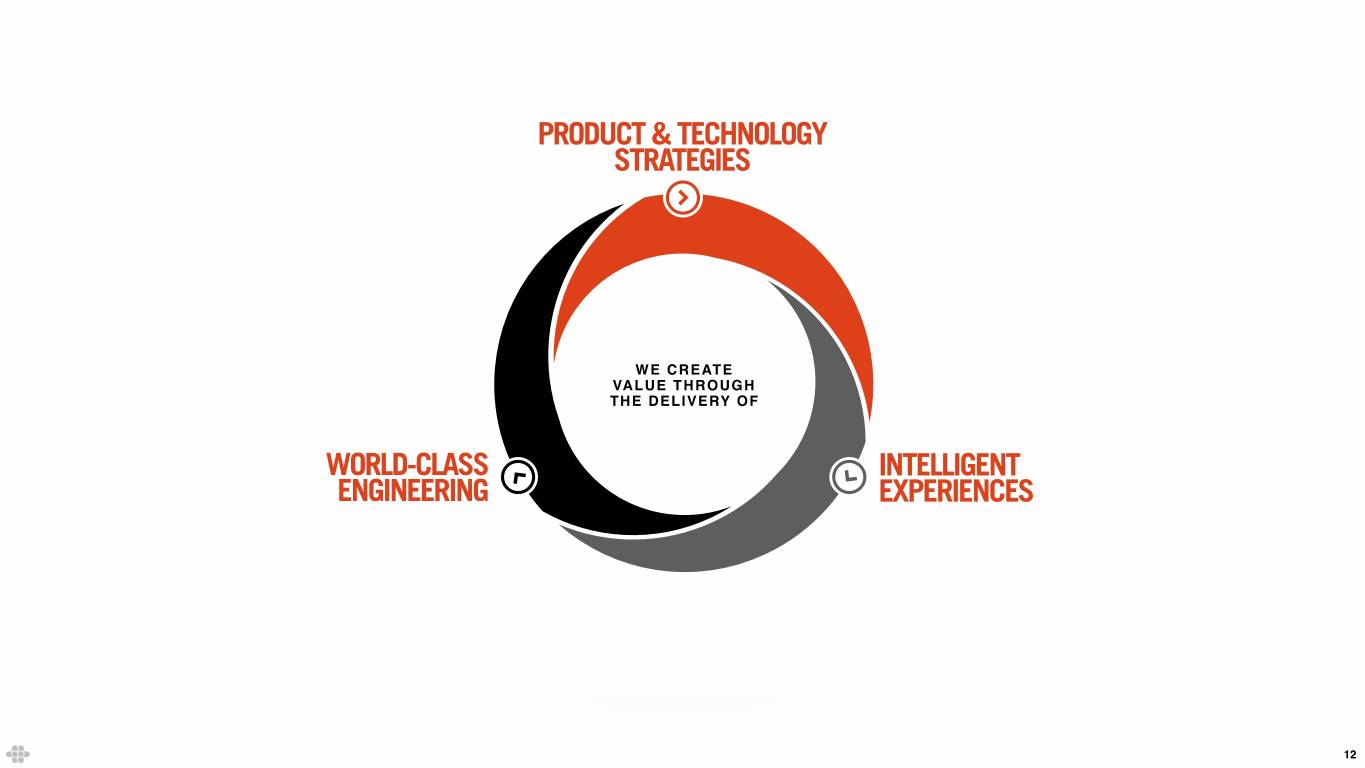

REIMAGINING THE RELATIONSHIP BETWEEN PEOPLE & TECHNOLOGY We accelerate our clients’ ability to take advantage of new business models and market opportunities by ideating and delivering dynamic platforms and intelligent digital experiences that are designed to fuel rapid, ongoing transformation of their businesses. By leveraging next-generation technologies, our agile, multi-disciplinary teams provide a combination of Product & Technology Strategies, Intelligent Experiences, and World Class Engineering to help our clients become more engaging, responsive, and efficient. 4

1 Q1 FY2021 Opportunity & Approach 55

The new reality We enable change IN OUR WORLD TODAY, MANY BUSINESSES WE ARE A LEADING NEXT-GEN TECHNOLOGY SERVICES PROVIDER AND HELP ARE PREPARING FOR EXTENDED PERIODS OF ACCELERATE DISRUPTION BY DELIVERING RAPID EVOLUTION TO ENTERPRISES. TIME DEFINED BY LIMITED PHYSICAL CONTACT BETWEEN HUMANS. OUR PEOPLE SYNTHESIZE CREATIVITY, TECHNOLOGY, AND DELIVERY AT SCALE IN MULTI-DISCIPLINARY TEAMS, ENABLING US TO SUPPORT OUR CLIENTS FROM AN ORGANIZATION’S ABILITY TO OPERATE IDEATION TO PRODUCTION. PRIMARILY IN A DIGITAL LANDSCAPE MAY DICTATE ITS ABILITY TO BOTH SURVIVE FROM PROOF OF CONCEPT, TO PROTOTYPE, TO PRODUCTION, WE USE OUR AND SUCCEED. ENGINEERING EXPERTISE TO DELIVER ENTERPRISE PRODUCTS AND PLATFORMS CAPABLE OF HANDLING MILLIONS OF TRANSACTIONS PER DAY. WE BELIEVE, MOVING FORWARD, TRUE DIGITAL TRANSFORMATION AND THE IN THIS NEW REALITY, WE’LL BUILD THE EXPERIENCES, TECHNICAL ESTABLISHMENT OF A FLEXIBLE BUSINESS SCAFFOLDING, AND INFRASTRUCTURE DESIGNED TO ENABLE AN ENTIRELY NEW MODEL WILL BECOME MISSION CRITICAL SET OF INTERACTIONS BETWEEN PEOPLE AND TECHNOLOGY. FOR BUSINESSES. 66

LARGE AND FAST GROWING MARKET OPPORTUNITY DELIVER RAPID EVOLUTION BY STRONG GROWTH COMBINING NEXT-GEN AND FINANCIAL TECHNOLOGIES WITH PERFORMANCE DEEP INDUSTRY FOUNDER-LED, EXPERIENCED EXPERTISE MANAGEMENT TEAM WITH STRONG CULTURE IDEATION TO PRODUCTION CAPABILITIES, DISTRIBUTED AGILE AT SCALE, DOMAIN EXPERTISE AND NEAR-SHORE DELIVERY 7

ENGINEERING NEXT-GEN TECH ENTERPRISE AGILE STRATEGY

AUTOMATION USER EXPERIENCE TRADITIONAL BUS. & TECH IT SERVICES CONSULTANTS DIGITAL

AGENCIES 8

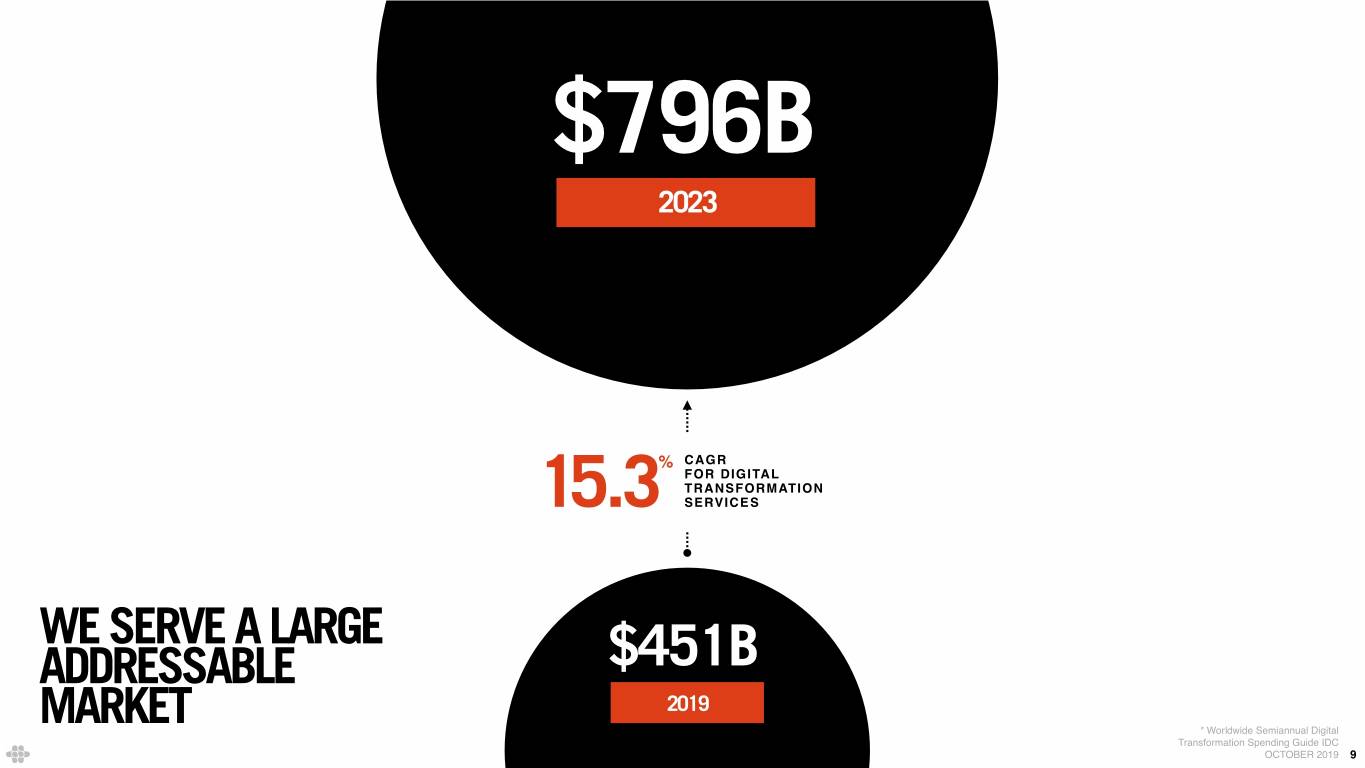

$796B 2023 % CAGR FOR DIGITAL

TRANSFORMATION

15.3 SERVICES WE SERVE A LARGE ADDRESSABLE $451B 2019 MARKET * Worldwide Semiannual Digital Transformation Spending Guide IDC OCTOBER 2019 9

GLOBAL EMPLOYEES 7,199 AS OF SEP 30, 2020 NEARSHORE DELIVERY CLOSE TO CLIENT European Union:

Austria Romania, Bulgaria and Slovenia

Denmark Germany Central European:

Ireland North Macedonia, Moldova, Serbia. Netherlands Bosnia & Herzegovina United Kingdom

United States Latin America:

Argentina, Colombia,

Uruguay & Venezuela 44 OFFICES // 41 CITIES // 18 COUNTRIES EMPLOYEE GEOGRAPHY (INCLUDING DIRECTORS): FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 Western Europe 237 233 232 254 448 257 465 Central Europe - EU Countries 1,572 2,314 2,578 3,062 3,368 3,072 3,638 1,809 2,547 2,810 3,316 3,816 3,329 4,103 Central Europe - Non-EU Countries 928 1,073 1,279 1,583 1,810 1,659 2,117 Latin America - 68 665 780 895 830 879 North America 58 56 65 75 103 86 100 2,795 3,744 4,819 5,754 6,624 5,904 7,199 10

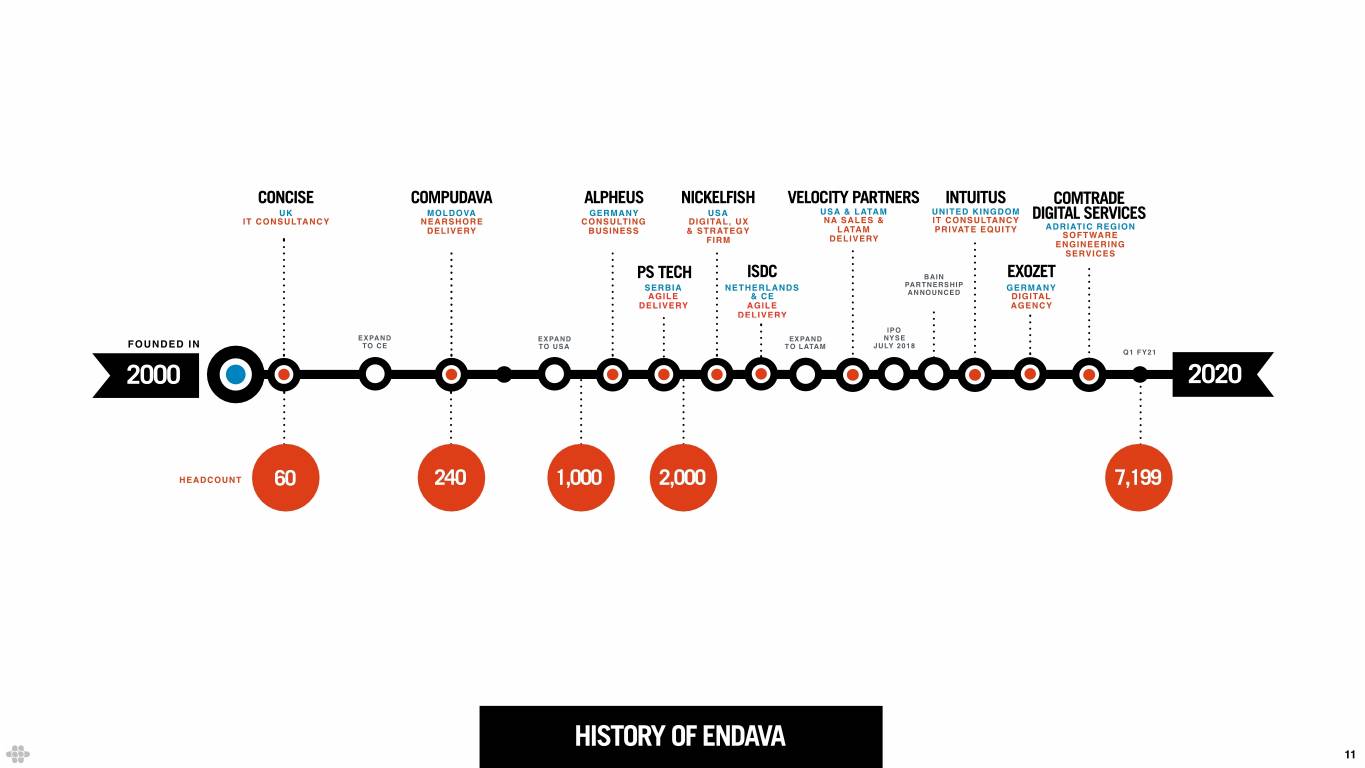

CONCISE COMPUDAVA ALPHEUS NICKELFISH VELOCITY PARTNERS INTUITUS COMTRADE UK MOLDOVA

GERMANY

USA

USA & LATAM

UNITED KINGDOM

IT CONSULTANCY NEARSHORE

CONSULTING DIGITAL, UX

NA SALES & IT CONSULTANCY DIGITAL SERVICES DELIVERY BUSINESS & STRATEGY

LATAM PRIVATE EQUITY ADRIATIC REGION

DELIVERY SOFTWARE FIRM ENGINEERING SERVICES PS TECH ISDC BAIN EXOZET SERBIA

NETHERLANDS

PARTNERSHIP GERMANY AGILE & CE

ANNOUNCED DIGITAL DELIVERY AGILE AGENCY DELIVERY IPO EXPAND

EXPAND

EXPAND

NYSE FOUNDED IN TO CE TO USA TO LATAM JULY 2018 Q1 FY21 2000 2020 HEADCOUNT 60 240 1,000 2,000 7,199 HISTORY OF ENDAVA 11

WE CREATE VALUE THROUGH THE DELIVERY OF 12

BUSINESS ANALYSIS PE DIGITAL & IT ADVISORY DATA & ANALYTICS

PROGRAMME MANAGEMENT DIGITAL PRODUCT STRATEGY TECHNOLOGY STRATEGY AGILE APPLICATIONS MGMT ARCHITECTURE CLOUD INFRASTRUCTURE

EXTENDED REALITY DEVSECOPS

MACHINE LEARNING & AI

SERVICE DELIVERY PRODUCT DESIGN SMART DESK

USER EXPERIENCE DESIGN TELEMETRY & MONITORING VISUAL DESIGN AUTOMATED TESTING. DISTRIBUTED AGILE DELIVERY CLOUD NATIVE SOFTWARE ENG. INTELLIGENT AUTOMATION CONTINUOUS DELIVERY . SECURE DEVELOPMENT 13

TODAY BANKING PAYMENTS HEALTHCARE RETAIL / CPG LOGISTICS TIME TECHNOLOGY DISRUPTION WAVES & CONVERGENCE 14

FRICTIONLESS PAYMENTS QUANTUM PROTOTYPING BIOMETRIC SCHEMELESS REAL CRYPTOCURRENCY OMNI-CHANNEL OPEN APIs CUSTOMER CENTRIC UX MICRO MERCHANTS SMART POS & NANO PAYMENTS PSD2 SYSTEMS COMPUTER VISION IN APP P2P ROBOTIC

AUTOMATION ROI OPPORTUNITY MESSAGE

PAYMENTS APPS CHATBOTS BLOCKCHAIN PLATFORMS AR FINANCIAL INCLUSION 2016 2017 2018 2019 2020 DOMAIN EXPERTISE: PAYMENT 15

Scalability BRAND CULTURE M&A AS WE STRIVE TO BE THE TO SUPPORT THIS GROWTH, WE NEED WE USE TUCK-IN ACQUISITIONS TO ASPIRATIONAL BRAND FOR IT LEADERSHIP AND HAVE DEVELOPED ACCELERATE OUR GROWTH STRATEGY - PROFESSIONALS IN THE REGIONS IN THE ‘PASS IT ON’ INITIATIVE WHICH TO EITHER ESTABLISH OURSELVES IN A WHICH WE OPERATE, WE ATTRACT DRIVES LOYALTY AND LOWERS NEW GEO OR TO ESTABLISH A NEW AREA HIGH QUALITY TALENT. ATTRITION. OF EXPERTISE AND MARKET GROWTH. 16

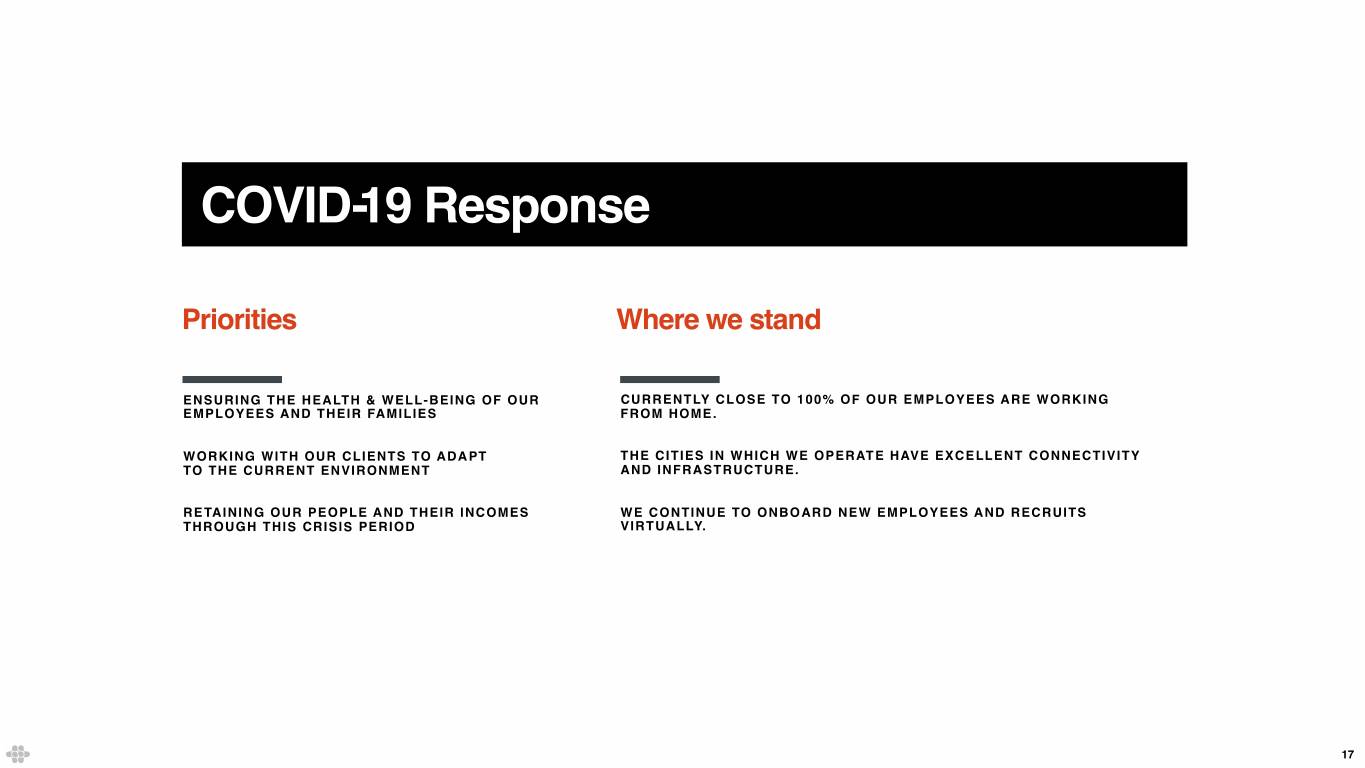

COVID-19 Response Priorities Where we stand ENSURING THE HEALTH & WELL-BEING OF OUR CURRENTLY CLOSE TO 100% OF OUR EMPLOYEES ARE WORKING EMPLOYEES AND THEIR FAMILIES FROM HOME. WORKING WITH OUR CLIENTS TO ADAPT THE CITIES IN WHICH WE OPERATE HAVE EXCELLENT CONNECTIVITY TO THE CURRENT ENVIRONMENT AND INFRASTRUCTURE. RETAINING OUR PEOPLE AND THEIR INCOMES WE CONTINUE TO ONBOARD NEW EMPLOYEES AND RECRUITS THROUGH THIS CRISIS PERIOD VIRTUALLY. 17

2 Q1 FY2021 Financials 18

Financial

Highlights MASTER SERVICE AGREEMENTS WITH CLIENTS PRIMARILY T&M BASED PRICING LONG-TERM CLIENT RELATIONSHIPS STRONG REVENUE GROWTH HEALTHY MARGINS LOW CAPEX REQUIREMENTS POSITIVE ADJUSTED FREE CASH FLOW 19

Revenue (£m) +15.5% YOY CAGR 33.1% 84.1 115.4 159.4 217.6 287.9 351.0 82.4 95.1 FY15 FY16 FY17 FY17 FY19 FY20 _ 6m18 6m19 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 JUNE 30 SEP 30 OVER LAST 5 YEARS, 89.4% OF REVENUE (ON AVERAGE) EACH FISCAL YEAR WAS GENERATED FROM CLIENTS IN THE PREVIOUS YEAR. STRONG REVENUE GROWTH 20

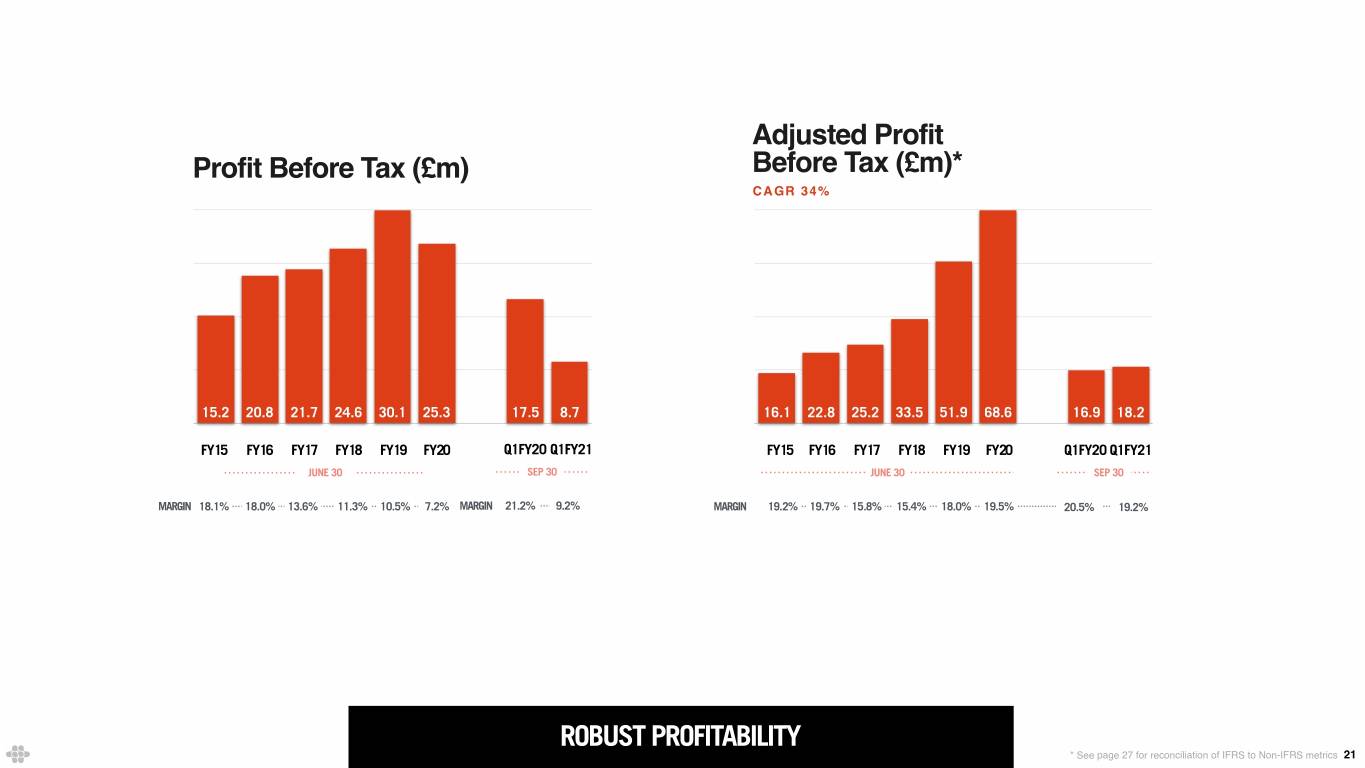

Adjusted Profit Profit Before Tax (£m) Before Tax (£m)* CAGR 34% 15.2 20.8 21.7 24.6 30.1 25.3 17.5 8.7 16.1 22.8 25.2 33.5 51.9 68.6 16.9 18.2 FY15 FY16 FY17 FY18 FY19 FY20 _ FY17 FY18 FY15 FY16 FY17 FY18 FY19 FY20 _ FY17 FY18 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 JUNE 30 SEP 30 JUNE 30 SEP 30 MARGIN 18.1% 18.0% 13.6% 11.3% 10.5% 7.2% MARGIN 21.2% 9.2% MARGIN 19.2% 19.7% 15.8% 15.4% 18.0% 19.5% 20.5% 19.2% ROBUST PROFITABILITY * See page 27 for reconciliation of IFRS to Non-IFRS metrics 21

Top Client Revenue % TOP TEN No. of Clients / Revenue > £1m* 66% 54% 49% 42% 38% 38% 41% 39% 18 26 34 46 63 65 62 66 FY15 FY16 FY17 FY17 FY17 FY17 q218 q219 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 FY15FY15 FY16 FY17FY17 FY18 FY18FY19 FY20 _ Q1FY20FY18Q1FY21 JUNE 30 SEP 30 JUNE 30 SEP 30 DEEP CLIENT RELATIONSHIPS * Calculated on a 12 month rolling basis. 22

Total No. of Clients Average Spend: Average Spend: TOP TEN CLIENTS (£000s) REMAINING CLIENTS (£000s) 13380 10035 6690 3345 112 154 188 258 275 416 278 501 5,510 6,200 7,820 9,040 10,870 13,380 3,340 3,740 284 434 504 597 699 647 252 218 0 FY15 FY16 FY17 FY17 FY17 FY20 _ FY17 FY18 FY15 FY16 FY17 FY18 FY19 FY20 Q218 Q219 FY15 FY16 FY17 FY18 FY18 FY18 - Q218 Q219 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 AS OF JUNE 30 SEP 30 JUNE 30 SEP 30 JUNE 30 SEP 30 INCREASING NUMBER & SPEND OF CLIENTS 23

RoW N.AMERICA EUROPE Revenue by Region UK 3% 2% 3% 0.3 0.2 0.3 22% 10% 18% 16% 12% 21% 27% 27% 29% 29% 18% 28% Q1 FY21 34% 34% 28% 24% 26% 25% REVENUE % BY VERTICAL 50% 78% 64% 50% 45% 45% 44% 45% 43% FY15 FY16 FY17 FY18 FY19 FY20 _ FY19 FY20 PAYMENTS AND FINANCIAL SERVICES FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 TECHNOLOGY, MEDIA & TELECOMMUNICATIONS JUNE 30 SEP 30 OTHER* DIVERSE REVENUE BASE: GEOGRAPHY & INDUSTRY VERTICALS * Other includes consumer products,

healthcare, mobility and retail verticals 24

Adjusted Free Capital Expenditures (£m) Cash Flow (£m)* 32.00 24.00 16.00 8.00 2.1 2.7 6.5 5.4 7.3 9.7 2.5 0.6 9.5 10.1 11.2 28.7 29.8 31.5 13.5 21.2 0.00 FY15 FY16 FY17 FY18 FY18 FY20 _ FY17 FY18 FY15FY15 FY16 FY17FY17 FY18 FY18FY19 FY20 _ Q1FY20FY18Q1FY21 FY15 FY16 FY17 FY18 FY19 FY20 Q1FY20 Q1FY21 JUNE 30 SEP 30 JUNE 30 SEP 30 % OF REVENUE 2.5% 2.4% 4.1% 2.5% 2.5% 2.8% 3.0% 0.6% 11.3% 8.8% 7.0% 13.2% 10.4% 9.0% 16.4% 22.3% MARGIN LOW CAPEX & POSITIVE ADJUSTED FCF * See page 27 for reconciliation of IFRS to Non-IFRS metrics 25

3 Q1 FY2021 Appendix 26

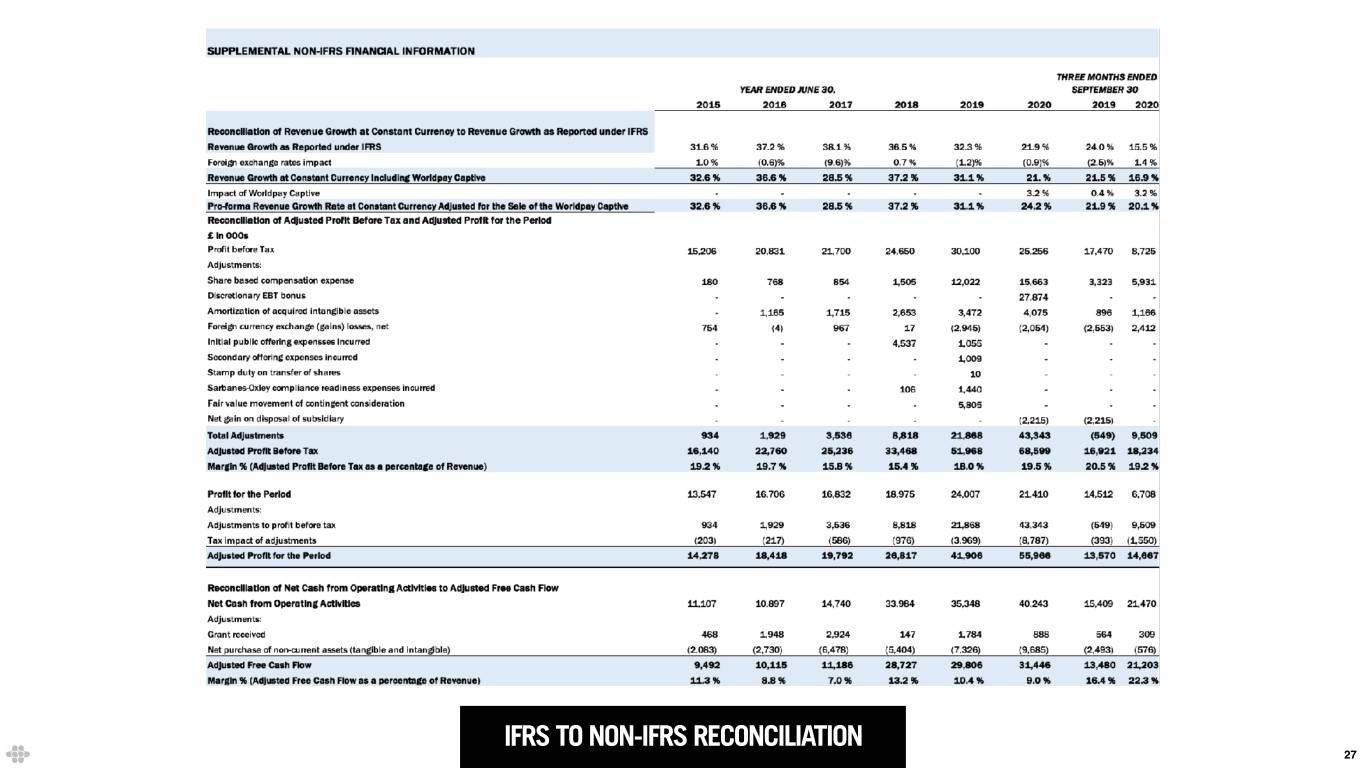

IFRS TO NON-IFRS RECONCILIATION 27